Apple reports blowout first quarter, generating more than $100 billion in revenue

Apple (AAPL) on Wednesday

reported its largest quarter by revenue for the first time, at $111.4 billion.

The result of the tech giant’s first-quarter earnings report for fiscal 2021

helped Apple to cross the symbolic $100 billion mark, sales were also up 21%

year over year.

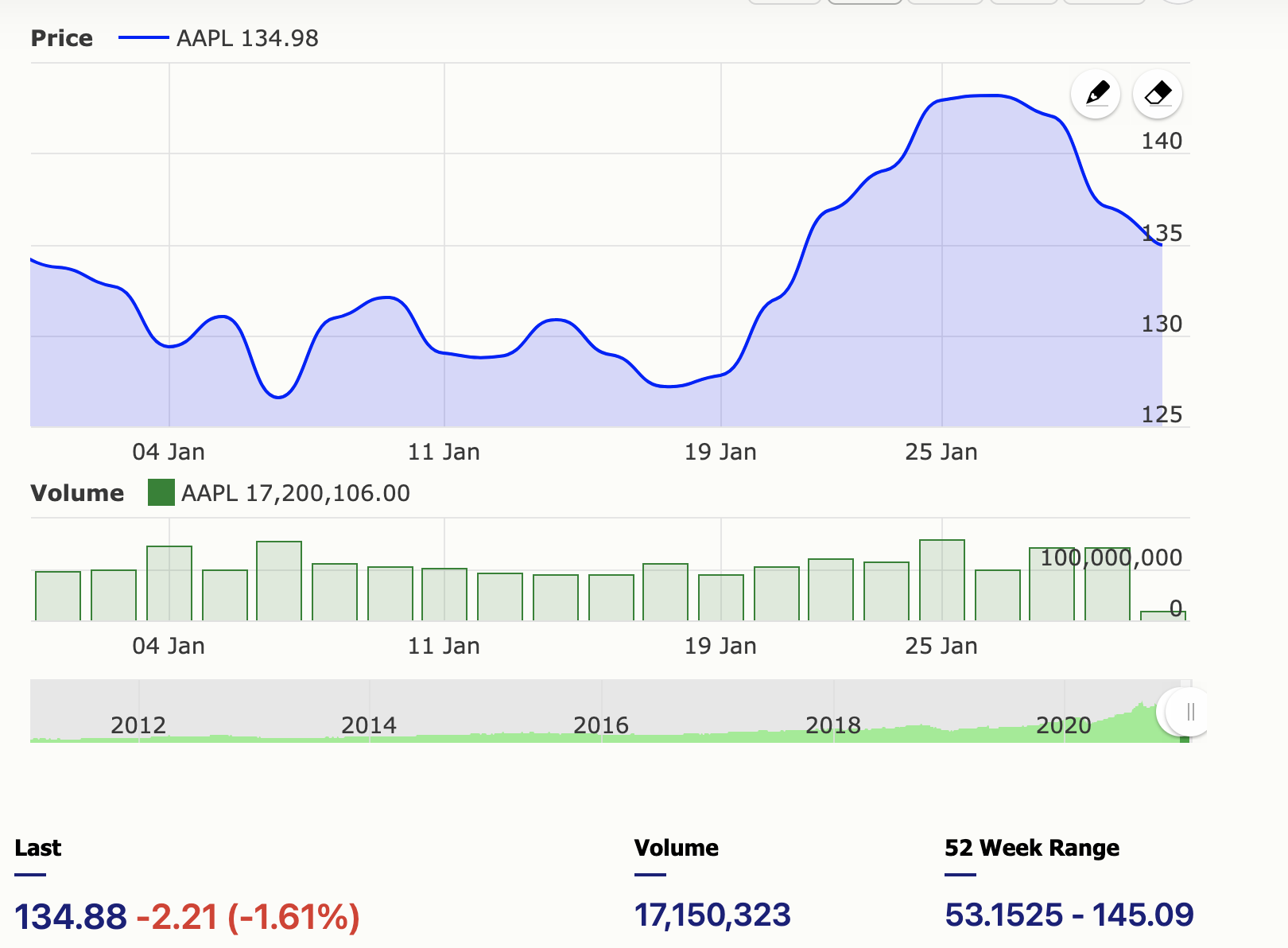

In extended trading,

shares of Apple dropped 2%, nonetheless, the company has begun the year on

strong.

Apple’s results for the

quarter that ended December was mostly driven by the sales of the 5G iPhones.

Also, sales for every product category doubled in a digit percentage point. The

tech giant’s revenue and earnings per share, by far, beat Wall Street

expectations.

Tim Cook, Apple CEO said

the results would have performed better it wasn’t for the COVID-19 pandemic and

global lockdowns that temporarily closed down some Apple stores around the

world.

Here’s how Apple Company performed in the first quarter:

·

Earnings per share (EPS): $1.68, vs $1.41

Refinitive estimate

·

Revenue: $111.44 billion vs. $103.28

billion Refinitive estimate

·

iPhone revenue: $65.60 billion, vs $59.80

billion Refinitive estimates, up 17% year over year

·

Services revenue: $15.76 billion, vs

$14.80 billion estimated, up 24% year over year

·

Other Apple products revenue: $12.97

billion, vs $11.96 analysts’ estimates, up 29% year over year

·

Mac revenue: $8.68 billion vs, $8.69

billion estimated, up 21% year over year

·

IPad revenue: $8.44 billion vs $7.46

billion Refinitive estimates, up 41% year over year

·

Gross margin: 39.8% vs 38.0% estimated

“Taking the stores out of

the equation, particularly for iPhones and wearables, there’s a drag on sales,”

Cook told CNBC. He added that Apple’s total install base for its iPhones is

over 1 billion, higher than the previous 900 million. Apple’s total active

install base for all its products is 1.65 billion.

While Apple celebrates

its $100 billion sales mark, it did not provide official guidance for the next

quarter. The company hasn’t also given investors forecasts since the wake of

the coronavirus pandemic. Without a doubt, Apple’s blowout quarter is a good

sign for investors.

In the just-reported

quarter’s result, about 58% of the total revenue was generated from the sales

of the new iPhone 12 models which were released in October 2020.

“This quarter for Apple

wouldn’t have been possible without the tireless and innovative work of every

Apple team member worldwide,” said Cook. “We’re gratified by the enthusiastic

customer response to the unwatched line of cutting-edge products that we

delivered across a historic holiday season. We are also focused on how we can

help the communities we’re part of build back strongly and equitably, through

efforts like our Racial Equity and Justice Initiative as well as our multi-year

commitment to invest $350 billion throughout the United States.”

The new iPhone 12 models

are the first to include the 5G network, which investors strongly believe could

drive a “supercylce” of users seeking an upgrade. Cook said the iPhone models

are “full of features that customers love, and they came in at exactly the

right time, with where 5G networks were.”

Be the first to comment!

You must login to comment