Biden’s Tax Increase: Corporations that would pay more

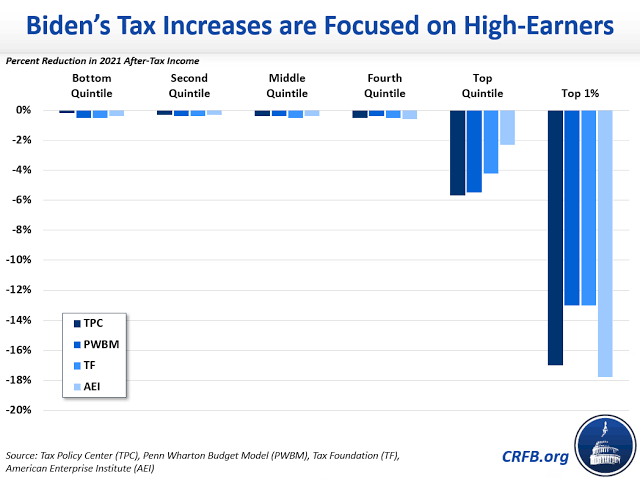

During the 2020 presidential election campaigns, President Joe Biden proposed a tax increase plan that would require certain high-earning companies and individuals to pay more taxes.

The Biden proposed tax increase was in contrast to the policies and major tax reductions that were enacted during the Trump administration. The tax increase rates would be individuals who earn $400,000 and above in income, as well as large corporations which would be subject to a new minimum tax on book income, that is, at least $100 million of book income.

The new tax would include a minimum 15 percent tax rate on income reported on financial statements of the concerned corporations. Foreign taxes will be creditable, and carryovers would also be allowed, according to reports. These carryovers are for years with negative minimum tax liability.

Here’s a breakdown of the new tax rates:

Top individual federal income tax rate: 39.6% from 37% Trump rate.

Individuals earning $400,000 and more would pay additional payroll taxes.

Corporate tax rate: 28% from 21%; a 15% alternative minimum tax which would apply to corporations with book income of $100 million and above

The maximum Child and Dependent Tax Credit could rise to $8,000 from $3,000 ($16,000 for more than one dependent)

Tax relief on student debt forgiveness would be offered and first-time homebuyers credit would be reinstated.

The estate tax exemption would drop by approximately 50%

Forbes estimates that 33 of the largest 100 U.S. corporations could be subject to the tax increase proposal if it were enacted as independent legislation. However, the president’s proposal of other significant tax increases on U.S. corporations could cause the effect of the proposed minimum tax to be much less, the outlet said.

A recent study by S&P Capital IQ shows 15 companies that are likely to pay most under President Biden’s 15% minimum tax. These companies include:

Apple (NASDAQ: APPL)

Net Income: $63.93B

Microsoft (NASDAQ: MSFT)

Net Income: $51.31B

Berkshire Hathaway (NYSE: BRK.A)

Net Income: $42.52B

Alphabet (NASDAQ: GOOGL)

Net Income: $40.27B

Facebook (NASDAQ: FB)

Net Income: $29.15B

JPMorgan Chase (NYSE: JPM)

Net Income: $29.13B

Amazon (NASDAQ: AMZN)

Net Income: $21.33B

Intel (NASDAQ: INTC)

Net Income: $20.90B

Bank of America (NYSE: BAC)

Net Income: $17.89B

Verizon (NYSE: VZ)

Net Income: $17.80B

United Health (NYSE: UNH)

Net Income: $15.40B

Johnson & Johnson (NYSE: JNJ)

Net Income: $14.71B

Procter & Gamble (NYSE: PG)

Net Income: $13.85B

Walmart (NYSE: WMT)

Net Income: $13.51

Home Depot (NYSE: HD)

Net Income: $12.87B

Note: Net Income is for the last 12 months each company reported

Be the first to comment!

You must login to comment