Micheal Burry just put up $1.6 billion of Scion capital funds on the line that the USA stock market will crash

- Posted on August 18, 2023

- Editors Pick

- By admin

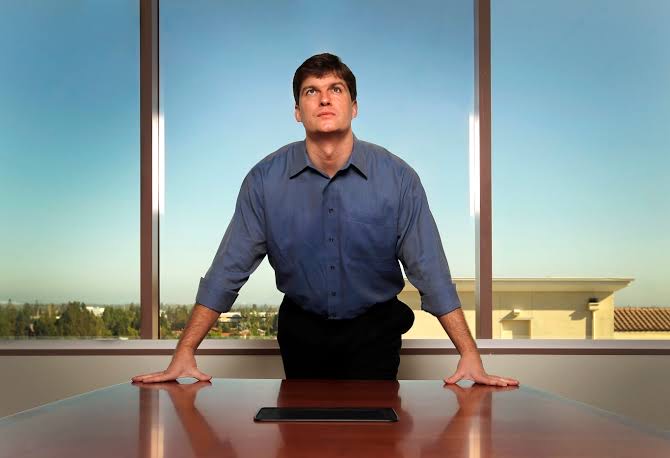

Michael Burry, the famed investor known for successfully predicting the housing market collapse in 2008, has recently staked over $1.6 billion on a potential crash in the financial markets. Burry's bearish positions are primarily against the S&P 500 and Nasdaq 100, as indicated by documents filed with the Security Exchange Commission on Monday. His investment firm, Scion Asset Management, acquired put options worth $866 million for a fund tracking the S&P 500 and $739 million for a fund tracking the Nasdaq 100.

This strategic move reflects Burry's allocation of more than 90% of his portfolio towards betting on a market downturn, based on the disclosed filings. However, there have been signs of fluctuating sentiment in Burry's investment choices throughout the year. In January, he posted a cryptic tweet to his sizable following, advising them to "sell." Yet, by the end of March, he retracted that stance, acknowledging, "I was wrong to say sell."

Despite Burry's pessimistic positions, the S&P 500 and Nasdaq 100 have demonstrated significant growth in the current year, achieving gains of approximately 16% and 38%, respectively.

In the mid-2000s, Burry gained prominence by successfully wagering against the housing market, reaping substantial profits from the subsequent subprime lending crisis and the collapse of major financial institutions in 2008. His experiences were chronicled in Michael Lewis's bestselling book "The Big Short: Inside the Doomsday Machine," which later inspired a film featuring Christian Bale as Burry.

Scion Asset Management has also divested from several regional banks, liquidating its holdings in First Republic Bank (FRC), Huntington Bank PacWest (PACW), and Western Alliance (WAL). The timing of these sales in relation to JPMorgan Chase's acquisition of First Republic Bank in May remains unclear.

Additionally, Burry reversed his position on Chinese stocks during the second quarter, selling his shares in JD.com (JD) and Alibaba (BABA).

While Burry has identified specific companies for investment, his bearish outlook often garners more attention in financial circles. It is worth noting that past success doesn't guarantee future returns, yet Burry has built a robust investment track record. Scion's disclosed investments over the past three years, between May 2020 and May 2023, yielded an annualized return of 56%, as compared to the S&P 500's approximately 12% annualized return over the same period.

Be the first to comment!

You must login to comment