The U.S. $900 billion COVID-19 stimulus... It's better than nothing

The $ 900 billion pandemic support package, due to be approved by Congress on Monday, will provide support for a recession-stricken economy slowing amid a deadly surge in coronavirus, preparing it for a stronger recovery next year when vaccines become more widespread, economists said.

The coronavirus relief package is here, it big, but it's not a good deal for poor people who are badly affected by the coronavirus pandemic.

But it comes months after the last big stimulus aid package was passed and lacks direct help to struggling states and cities, as millions remain unemployed and businesses suffer anew from fresh restrictions to slow the spread of the virus.

“While the deal is months late and will likely fall short of what is needed to prevent a rough winter, it’s better than nothing,” said Gregory Daco, the chief U.S. economist for Oxford Economics.

Even before it is signed, there is fierce debate over whether more aid will be needed, and if it will reach the neediest Americans.

Still, San Francisco Federal Reserve President Mary Daly called the aid “unequivocally beneficial” in an interview on Sunday on CBS’ “Face the Nation.”

BRIDGE TO BETTER TIMES

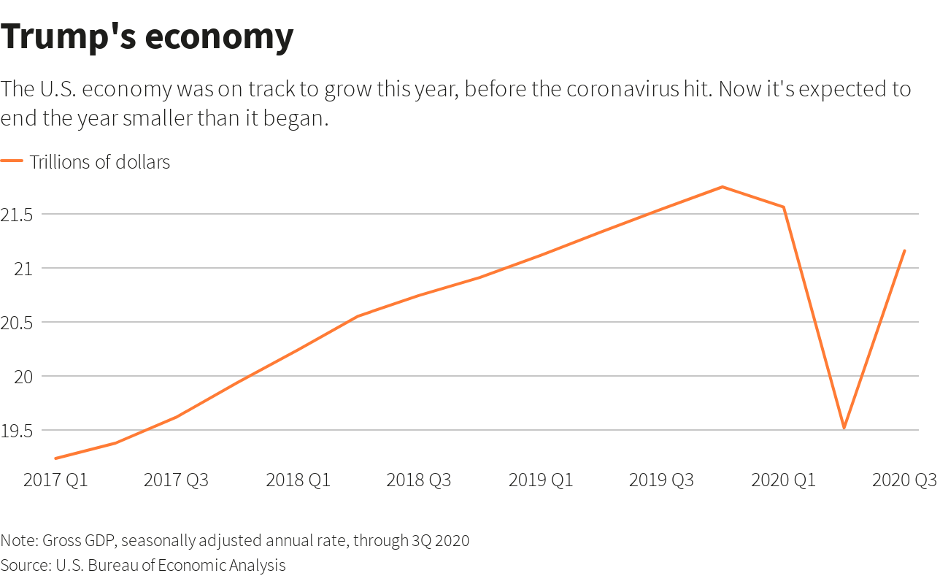

The U.S. economy is roughly $1 trillion smaller than what it would have been without the pandemic and resulting recession.

That estimate is based on the gap between where economic output was headed this year before the onset of the health crisis - it started 2020 at about $21.7 trillion - and where it is now.

The new bill, at roughly the size of that gap, contains $166 billion for checks to most Americans, $120 billion in extra payments to the unemployed, and nearly $300 billion in new “payroll protection” loans for companies that keep employees on the books, among other things.

To Carl Tannenbaum, chief economist at Northern Trust in Chicago, the package’s correlation with U.S. economic gap is one indication “they’ve sized (it) almost properly.”

The economy is expected to rebound strongly next year once vaccines make it safer to be out and about, he said, so there's less of a need for the $2 trillion or more than some economists, like those at the Economic Policy Institute here, have called for.

Kathryn Anne Edwards, an economist at Rand who focuses on the labor market, said the lessons of recent history suggest that spending too little would be a mistake.

“In past recessions, we erred on the side of being fiscally conservative... and it was not enough and people were unemployed for a staggering amount of time,” Edwards said.

TARGETED HELP FOR JOBLESS

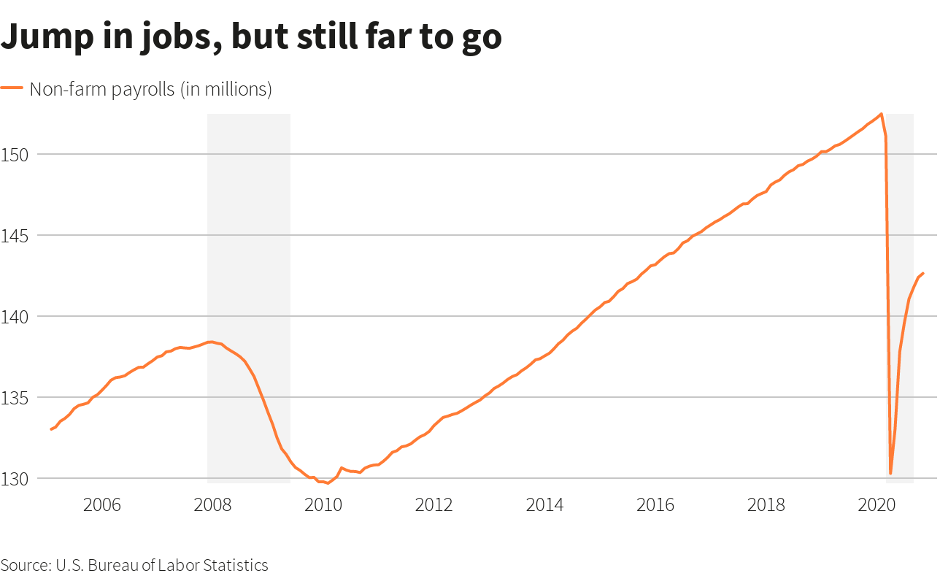

Of 22 million jobs shed since the start of the pandemic, about 12 million have come back, leaving a shortfall of nearly 10 million, Labor Department data show.

The package will add $300 per week to regular unemployment benefits through mid-March, and extend benefits to gig workers who otherwise would not qualify, that was set to expire this week. It also extends an eviction moratorium through January.

Taking care of the unemployed, whose benefits were going to expire is “the most urgent thing that needs to be done right now,” said Wendy Edelberg, director of the Hamilton Project and senior fellow at the Brookings Institution. Still, she worries more help will be needed soon.

“My main concern is that the support – for unemployment insurance but also the eviction moratorium – doesn’t last nearly long enough, she said. “The economic weakness could come pretty fast in the first quarter.”

Targeting funds to people who have lost their jobs is an extremely effective use of government aid, economists say, because it helps the neediest and because it is likely to be spent quickly and fully, delivering a boost to the economy.

At the end of November, 20.6 million Americans were receiving some form of unemployment benefit, Labour Department figures show.

BROADER SUPPORT WITH $600 CHECKS

Official unemployment numbers do not adequately reflect the total need in the United States, economists say.

“How many people are hungry right now, how many people are behind on rent, how many children are behind in school – these measures of hardship are not collected the way unemployment rates are,” says Rand’s Edwards.

The stimulus attempts to address that in part by giving Americans who made $75,000 or less last year one-time checks of $600, providing an immediate boost.

Other Americans may not need to use the money right away, said Arindrajit Dube, an economics professor at the University of Massachusetts, Amherst. U.S. households have built up more than $1 trillion in savings during the pandemic, data from the Federal Reserve shows.

That, along with any money saved from stimulus checks, is ammunition that will deliver “super-charged stimulus,” Dube predicted, once vaccinations become more widespread and people spend extra cash on summer travel or vacation rentals. “That will potentially speed our recovery much more than anything else.”

THE FATE OF SMALL BUSINESSES

Economists overall are less enthusiastic about the $284 billion in paycheck protection loans, the biggest chunk of the package’s $325 billion in aid to small businesses. Research on the $525 billion distributed under the program first created in March shows it “is pretty inefficient both as relief and as recovery,” said Josh Bivens, director of research at the Economic Policy Institute.

A study here by non-partisan Opportunity Insights suggested the cost per job saved by the PPP was $377,000.

That said, the program - which funnelled money to more than five million enterprises - should help bolster borrowers’ balance sheets, setting up for a faster recovery, Dube said.

The package includes no direct support for financially stressed state and local governments, which have reduced payrolls by slashing about 1.3 million jobs since February.

It does devote more than $250 billion to schools, transit, vaccine distribution, and testing, food aid, childcare, and rental assistance.

“Those kinds of fiscal support take some burden off of state and local governments,” Edelberg said.

Here’s what is in the package, according to a summary released by House of Representatives Speaker Nancy Pelosi and Senate Democratic Leader Chuck Schumer, and interviews with several congressional aides who provided additional details:

· Checks in the mail: The bill includes $166 billion in new direct payments of up to $600 per adult and child, for individuals making up to $75,000 a year and $1,200 for couples making up to $150,000 a year. The bill expands direct payments to mixed-status households.

· More unemployment benefits: An additional $300 per week for some unemployment recipients, with expanded coverage to the self-employed, “gig” workers, and others in non-traditional situations.

· A U.S. Postal Service grant: Congress agrees to convert a $10 billion loan approved in March into direct funding for USPS without requiring repayment.

· Payroll loans: $284 billion for government payroll loans, including expanded eligibility for non-profits and newspaper and TV and radio broadcasters, $15 billion for live venues, independent movie theatres, and cultural institutions and $20 billion for targeted disaster grants

· Back-to-school funding: $82 billion for colleges and schools, including for heating-and-cooling system upgrades to mitigate virus transmission and reopen classrooms, and $10 billion for childcare assistance. Includes $54.3 billion for K-12 schools and $22.7 billion for higher education

· Childcare: $10 billion to provide childcare assistance to families and to help childcare providers cover costs related to pandemic safety.

Business meal write-offs. A new tax break for business meal expenses, nicknamed the “three martini” deduction.

· Ending surprise medical billing: Insured patients only need to pay in-network costs when an emergency or other issue forces them to use a medical provider who isn’t covered by their network.

· Transport industry help: $45 billion for transportation aid, including $15 billion to U.S. passenger airlines for payroll assistance, $14 billion for transit systems, $10 billion for state highway funding, $2 billion for airports, $1 billion for airline contractors and $1 billion for passenger railroad Amtrak.

· Rent and eviction aid: $25 billion for rent and utility payment assistance for people struggling to stay in their homes, and an extension of the eviction moratorium until Jan. 31. States will receive a minimum of $200 million in assistance.

· Vaccine distribution aid: $30 billion to support procurement and distribution of the vaccine, “ensuring it’s free and rapidly distributed to everyone,” as Schumer said.

· More to fight hunger: $13 billion for food assistance, including additional funding for food banks and senior nutrition programs, college student access to the federal government’s Supplemental Nutrition Assistance Program.

· Farm aid: Another $13 billion for direct payments, purchases, and loans to farmers and ranchers.

Farmers of row crops like corn, soybeans, and wheat would receive an estimated $5 billion for supplemental $20 per acre payments, according to a statement from U.S. Senator Debbie Stabenow, ranking member of the Senate Agriculture Committee.

Record government farm subsidies of around $50 billion in 2020 were already expected to account for more than one-third of U.S. farmer income this year.

Up to $3 billion in direct payments to livestock and dairy farmers and contact farmers forced to euthanize livestock or poultry when the COVID-19 crisis closed slaughterhouses, according to Stabenow.

· Expanded Pell Grants: New grants for college tuition, which would reach 500,000 new recipients.

· Internet access: $7 billion to give more Americans broadband internet access, including $1.9 billion to replace telecom network equipment that poses national security risks and $3.2 billion for a new temporary benefit program to help low-income Americans get access to broadband service

· Global virus alliances: $4 billion for an international vaccine alliance

· Tax credits: Enhanced tax credits to encourage low-income housing construction, businesses to keep employees on the payroll, employers to provide paid sick leave, and for low-income workers.

· Minority-owned businesses: $12 billion for minority-owned and very small businesses that struggled to access earlier Payroll Protection Program financing.

· What’s not in the bill: Liability protection for companies whose employees get coronavirus, which Republicans have backed for months, was not included in the final negotiations or bill; Democrats laid aside sizable funds for state and local governments in return.

A last-minute attempt by the Republican Party to limit the Federal Reserve’s emergency lending power to small businesses and local governments was also left out.

The $ 900 billion pandemic support package, due to be approved by Congress on Monday, will provide support for a recession-stricken economy slowing amid a deadly surge in coronavirus, preparing it for a stronger recovery next year when vaccines become more widespread, economists said.

A lot of people invested the first stimulus money that they received from the government some months ago, and this helped the United State economy a lot. The new stimulus/covid relief package is here, it only $600 this time and we'll see if the public will invest it again. If the public decides to invest in the stock market again, we may see more record high in the 2020 stock market moves.

Be the first to comment!

You must login to comment