US Senate Passes New Bill That Could Delist Some Chinese Companies

- Posted on May 21, 2020

- Stock Market

- By Glory

On Wednesday, the United State Senate passed a bill that could remove publicly listed Chinese companies from American stock exchanges. These companies would no longer be able to sell shares on any of the American stock exchanges. Foreign companies that wish to be listed in America must follow US auditing standards and other financial regulations. Companies that fail to comply would be taken off.

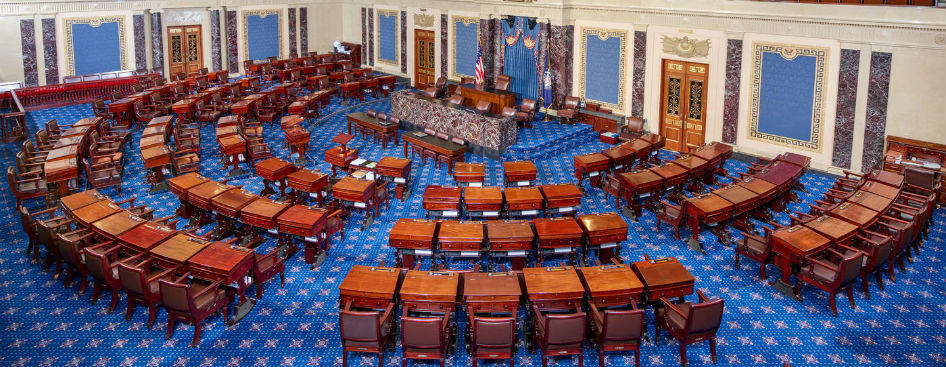

The bill was introduced by Sen John Kennedy, a Louisiana Republican, and co-sponsored by Sen. Chris Van, a Democratic of Maryland and Sen Kevin Cramer, a Democratic of North Dakota. The bill was titled ‘Holding Foreign Companies Accountable Act. The bill which was presented for unanimous consent by the three senators was approved without any objection.

According to Kennedy on the Senate floor, the legislation wasn’t a call for a “new cold war.” Rather, a call for “China to play by the rules.”

In the China Law Blog, Steve Dickinson of Harris Bricken wrote that American companies listed on Chinese exchanges were required to be audited by an accredited firm, monitored by the PCAOB. On the other hand, China has refused to allow its companies that raise money publicly in the US to follow US securities law. They argue that Chinese law does not permit auditors’ work to be transferred out of the country.

“Unlike companies from the U.S. and Europe and everywhere else in the world, Chinese companies that list on the U.S. stock exchanges are exempt from meaningful financial oversight.”

The legislation has successfully passed the Senate. It now has to be passed by the House of Representatives before it can be forwarded to President Trump to sign it into law. The legislation would also require foreign listed companies to state whether they are owned or controlled by their government, as well as submitting to an audit that can be reviewed by the Public Company Accounting Oversight Board.

The need for the bill arose as the tensions between the US and China increase due to controversies attached to the coronavirus pandemic, according to President Trump and other US politicians, China failed to curtail the virus in its early stages. China’s failure to do so has caused a ripple effect in global economies and societies, a pandemic that has claimed the lives of nearly 330,000 people, globally.

There is also the Luckin Coffee accounting scandal which has caused Nasdaq highly consider delisting the company. Luckin’s Nasdaq listing was one of China’s top-performing stocks in the US stock market in 2019. While the bill isn’t specific to any foreign country as it applies to all, the target is China. An internal investigation on Luckin Coffee revealed that hundreds of millions of its sales last year were “fabricated.”

According to the company, the investigation found a total of 2.2bn yuan ($310m) fabricated sales from the second quarter of 2019, making up nearly 40% of its total annual sales. Luckin has since sacked its chief executive and chief operating officer. There has also been an immediate suspension or leave for six other employees who were alleged to be directly or indirectly involved in the scandal.

The Chinese coffee chain is currently cooperating with US and China regulators who are currently running further investigations on the company.

The company confirmed on Tuesday that the Nasdaq exchange had informed it of a possible delisting due to the allegations of fabricated sales and disclosure failures. However, its share will continue to trade on the exchange for the next 45 days, pending on the outcome of the investigation. Prior to Wednesday, the company’s shares had been suspended since April 7, after resuming trading its shares plunged 35%.

Be the first to comment!

You must login to comment