What is PUT OPTION? Everything you need to know about buying and selling Put Option

- Posted on January 16, 2020

- Featured Education

- By admin

What Is a Put Option?

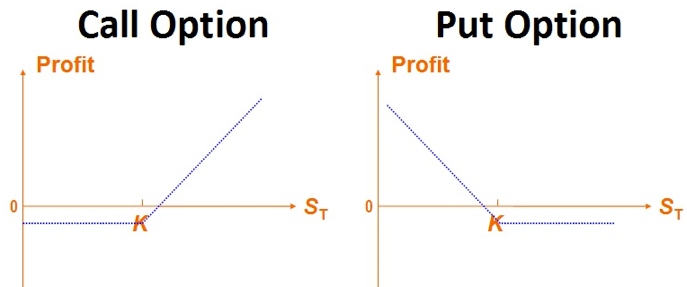

A put option refers to a contract that gives the owner the right, but not the obligation, to sell a specified amount of an underlying security at a pre-determined price within a specific time frame. The strike price is the specified price at which the put option buyer can sell. Put options can be traded like various underlying assets, including stocks, bonds, commodities, and indexes; and can be traded on brokerages. Put options allow buyers to magnify the downward movement of stocks, turning a small price decline into a huge gain for the put buyer. Puts are one of the two types of vehicles in stock options, along with calls. Each contract represents 100 shares of the “underlying” stock or the stock on which the option is based.

Put options act as a form of insurance, however, investors don’t have to own the stock to buy a put. Put buyers often expect the stock to decline, and a put provides a higher potential profit than short selling the stock.

How Put Options Work

A put option is more valuable as the price of the underlying stock depreciates relative to the strike price, while it loses its value as the underlying stock increases. Put options essentially provide a short position in the underlying asset, hence they are used to speculate on downside price action. A put ensures that losses in the underlying asset do not exceed the strike price.

In common cases, the value of a put option decreases as its expiry date approaches, and because of the probability of the stock falling below the specified strike price decreases. When an option loses its time value, the intrinsic value is left over. The intrinsic value is the difference between the strike price and the underlying stock price. If an option is "in the money" if it has an intrinsic value; it is "out of the money" and "at the money" if put options have no intrinsic value because there would be no benefit of exercising the option. Time value, or extrinsic value, is reflected in the premium of the option. At expiration, if the stock price is lower than the strike price, the put is worth the money. In this situation, the value of the put equals the strike price minus the stock price multiplied by 100, because each contract represents 100 shares.

Look at this example of a put option:

If an investor owns one put option of Apple stock (NASDAQ: AAPL) trading at...let's say $377.00, with a strike price of $360 expiring in one month. For this option, the investor pays a premium of $0.72 per share or $72 for 100 shares.

The investor has the right to sell 100 shares of AAPL at a price of $360 until the expiration date in one month.

Assuming shares of AAPL fall to $350 and the investor exercises the option, the investor could purchase 100 shares of AAPL for $350 in the market and sell the shares to the option's writer for $360 each. Consequently, the investor would make $1,000 (100 x ($360-$350)) on the put option. This means the net profit is $928 ($1,000 - $72 = $928), minus any commission costs. Input option, the maximum loss on the trade is limited to the premium paid, i.e., $72. These examples perfectly fits for a bearish investor.

If an investor is bullish on AAPL, which is currently trading at $377 and does not believe it will fall below $360 over the next two months. The investor could collect a premium of $0.72 (x 100 shares) by writing one put option on AAPL with a strike price of $360. The option writer would collect a total of $72 ($0.72 x 100). If AAPL stays above the $360 strike price, the investor would keep the premium collected, since the options would expire out of the money and be worthless. Therefore, the maximum profit on the trade is $72.

However, if AAPL moves below $360, the investor will be on the hook for purchasing 100 shares at $360, even if the stock falls to $350, or $300, or lower. The put option writer is liable for purchasing shares at $360, This means they will face the risk of $360 per share, or $36,000 per contract ($360 x 100 shares) if the underlying stock falls to zero.

Advantages of Put Options

Put options have several advantages which are outlined below:

They allow investors to sell options and generate income from the premium.

They cushion against risk, i.e., they limit risk while generating a capital gain.

Put options give investors the opportunity to achieve better buy prices on their stocks.

Trading Put options

Buying a put option

If a stock declines below the strike price before expiration, the option is considered to be “in the money.” The buyer is left with two choices. If he owns the stock, he can put the stock to the put seller at the strike price, i.e., above the market price and realize profit. Another choice is that, the buyer can sell the stock prior to expiration to capture the value, without selling any underlying stock. If the stock stays at the strike price or above it, the put is “out of the money” and the buyer loses her entire investment.

Selling a put option

Be the first to comment!

You must login to comment