What is Stock Short Selling? How to Sell Stock Short

“Short selling amounts to betting that a given stock will decline in value- in Wall Street lingo, that’s called having a “short” possession. Having a long possession means you actually own the stock and are betting that it will rise in value.”

There are different categories on investors who invest in stocks one of which is called ‘shorts’. Short investors are investors who take advantage of companies whose value drops by borrowing a stock, selling it, and buying it back to return to the lender. Hopefully, when buying back the stock, the short seller intends to get it back at a lower price before returning it to the lender. This type of investment is not designed for just any new investor. Shorting stocks is highly risky; if the short seller bets wrongly he stands to be at a loss and vice versa.

How does shorting work?

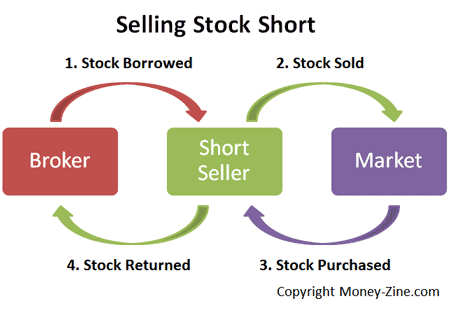

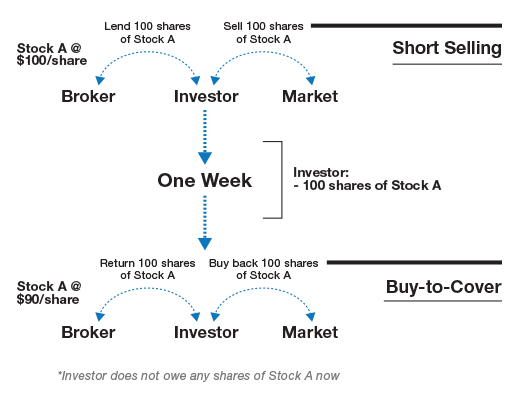

In reality, most short sellers do not own a stock, rather they borrow from brokers who own securities and are ready to offer a loan negotiation to the short seller. After borrowing shares, the next step is to sell the borrowed shares immediately at the current market price and wait for the stock price to decline before buying back the shares at the current declined price. Once a sale has been concluded and profit earned, you get to pocket the profits made from the cash sale and return the borrowed shares to the brokerage.

For example, assuming that Amazon stock is currently worth $330 per share and a stock seller thinks it is overvalued at that price. If he sees a possibility of the price dropping in the nearest future, he would go ahead to borrow a few shares of Amazon from his broker and sell them at the current market price which is $330 per share. If the stock actually drops to $315 like how the short seller suspected, he stands to make a net profit of $15 ($330 - $315) when he buys back the shares. On the other hand, if the price increases to $345, the short seller is at loss of -$15 ($330 - $345). Also note that there are commissions and fees charged by brokerages, though, they may slightly differ.

There are several reasons for shorting a stock some of which are suspecting that a stock’s price would likely decline, gaining tax advantage, to take advantage of the fall of a public-traded company, and hedge a long position already taken in a stock.

How to Short a Stock

Stock shorting may be a risky game for its investors, however, the process of getting started is less demanding. To short a stock you can take the following steps:

Set up a Margin Account with Your Brokerage Firm: With a margin account your brokerage firm lets you borrow stock or cash for investment or partake in a short sale. Setting up a margin account would require you to provide in-depth detail about your ability to handle all investment risk that comes with a short sale, and your ability to cover future losses.

Select Your Account Type: The account type can be an individual account, joint account, or corporate account. The available account types imply that short sale is not restricted to individual short sellers but open to all who can place good bets and handle the risks come with short sales.

Execute a Short Sale on Your Selected Stock Through Your Broker: You can go about this by contacting your broker to find shares that you perceive are likely to decline in prices and request to borrow the shares. The brokerage can either directly loan the shares out if they have any in their possession or look for investors who own the shares and borrows them on behalf of the short seller promising to return them at an agreed later date.

Understand the Rules Before Signing Off a Short Sale Order: Short selling is not for the faint of heart neither is it for people who do not understand the rules. There may be general rules that regulate the flow of short selling, however, most brokerage firms have custom rules on short sales. Some brokers may place a limitation on the number of shares you can borrow while others do not. Brokerages can also be limited by the type of shares they have—that is, not always having the type of shares a short seller may desire to borrow.

Buy Back the Stock and Pay Off the Loan: Whether or not the short seller makes any profit, buying back the stock and repaying the loan is still necessary. To buy back shares you would have to place a ‘buy order’ or ‘buy to cover’ order on the stock brokerage order ticket. The order ticket will indicate to the stockbroker that you want to cover the short sales by buying back the shares of the stock, repay the loan with the incurred interest, and conclude on the short sales process.

Risks of Short Selling

Short selling is a highly risky investment as investors stand to lose the money they invest if a bet goes wrong. It doesn’t take long for a short seller to recognize if a shorted stock would make a profit or not. Time also poses as a limitation for short-sellers as shorting usually takes up months rather than years. The more a stock increases in value contrary to what the investor predicted, the longer time it takes for the seller to make a profit, if at all the value ever drops at all. The longer time it takes for a stock value to decline the more the stock losses stack up. A short seller can only be at a profitable advantage if the stock price falls as soon as possible. Using a “margin call” the short seller’s brokerage would require the short seller to top the cash in their brokerage account to “cover a loan taken out for a stock position that is losing value.” Failure to cover the margin call would lead to a closedown of the short seller’s account, and attract charges for any investment losses suffered.

Conclusion

Short selling supports speculation by allowing speculators to use it to capitalize on the possibility of a major security or market decline and hedging by allowing hedgers to use short selling to mitigate losses in portfolio or security. Shorting selling is open to both individual investors and institutional investors who have gained mastery of investing and the risks that come with it.

Be the first to comment!

You must login to comment