Chesapeake Energy, Shale Pioneer Files for Bankruptcy

- Posted on June 29, 2020

- Stock Market

- By Glory

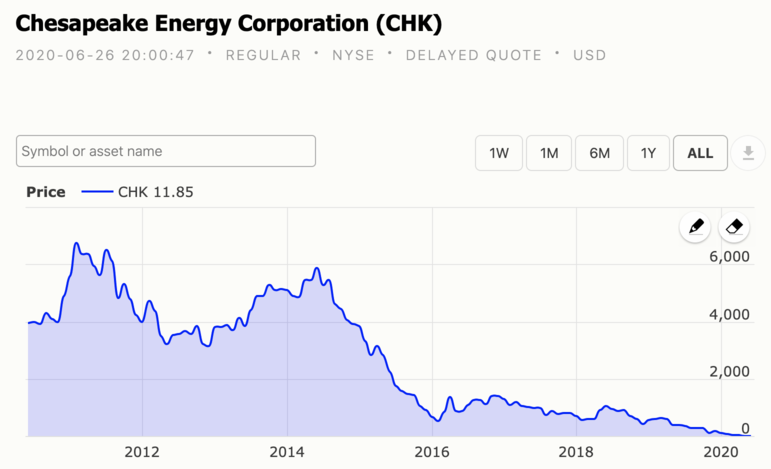

Chesapeake Energy (CHK) joins the list of bankrupt companies after the company filed for a Chapter 11 bankruptcy on Sunday, making it the biggest oil and gas company to seek bankruptcy protection in recent years. The coronavirus pandemic has greatly impacted the company causing it to depend heavily on debts over the last couple of months.

The oil and gas producer, Chesapeake was the company that pioneered shale gas drilling which turned the United States into a sought-after energy powerhouse. The company led the fracking boom where it used unconventional techniques to extract oil and gas from the ground. However, this method has come under scrutiny because of the possible impacts it may have on the environment.

The Oklahoma City-based company said its decision to enter bankruptcy protection was because its $9 billion debts were unmanageable. Chesapeake has entered an agreement plan with lenders to cut $7 billion of its debt and will continue its operations as usual during the bankruptcy process.

Chesapeake was founded in 1989 by Aubrey McClendon and Tom Ward with an initial amount of $50,000. When it was founded, the company concentrated its focus on drilling in underdeveloped and rural areas of Oklahoma and Texas. Rather than use traditional vertical well drilling techniques, the company opted for lateral drilling techniques used to free natural gas in an unconventional way.

The oil and gas producer soon became a colossus in the energy markets and it eventually hit a market valuation of over $37 billion. In 2008, Chesapeake saw a sharp decline in its revenues during the financial crisis that sent energy prices crumbling down.

The company experienced some of its best days under the leadership of McClendon as Chief executive before his death in a one-car crash in 2016. He died while facing a federal probe into bid-rigging. For over two decades, McClendon built Chesapeake, taking it from a wildcatter to a top U.S. oil and gas producer. The company remains the sixth-largest oil and gas producer by volume.

When the current CEO Dough Lawler took over running the company, it was saddled with debt worth nearly $13 billion, in 2013. He managed to cut some of the debt with spending cuts and asset sales. The same may not be possible for this year’s debt, as the fall of oil prices us beyond Chesapeake, hence, the company has been left without the ability to refinance its debt.

“Despite having removed over $20 billion of leverage and financial commitments, we believe this restructuring is necessary for the long-term success and value creation of the business,” Lawler said in a statement.

At the close of trading on Friday, the company was valued at nearly $115 million.

In the same statement that announced the company’s bankruptcy protection, Lawler said Chesapeake plans to cut approximately $7 billion of its debt. In a separate court filing, it was shown that Chesapeake has more than $10 billion in assets and liabilities combined.

Be the first to comment!

You must login to comment