Meek Mill Invests $50K In Dogecoin: How Black Millennials Are Seizing Investment Opportunities To Create Wealth

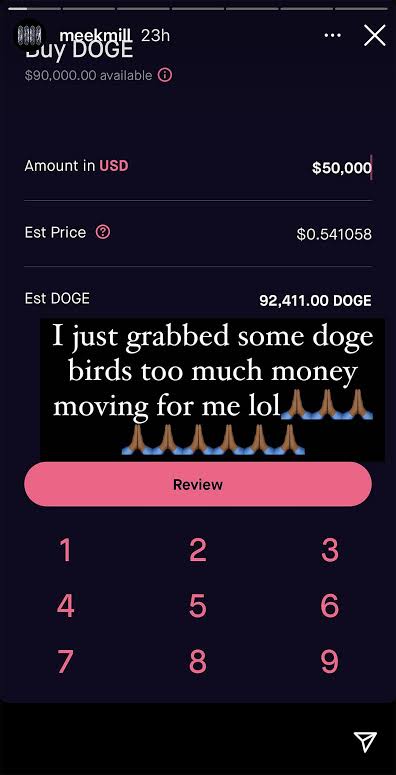

Meek Mill revealed he has purchased $50,000 worth of DogeCoin last week. The rapper posted a screenshot of the purchase on his Instagram story, after posting on Twitter that he was tired of missing out.

This goes to show how deeply the influence of crypto has permeated our lives, and not even celebrities are vulnerable. Rapper Nas has potentially cashed out from the crypto world, as his company's early investment in crypto exchange company, Coinbase, which went public on the 14th of April, has yielded mega returns.

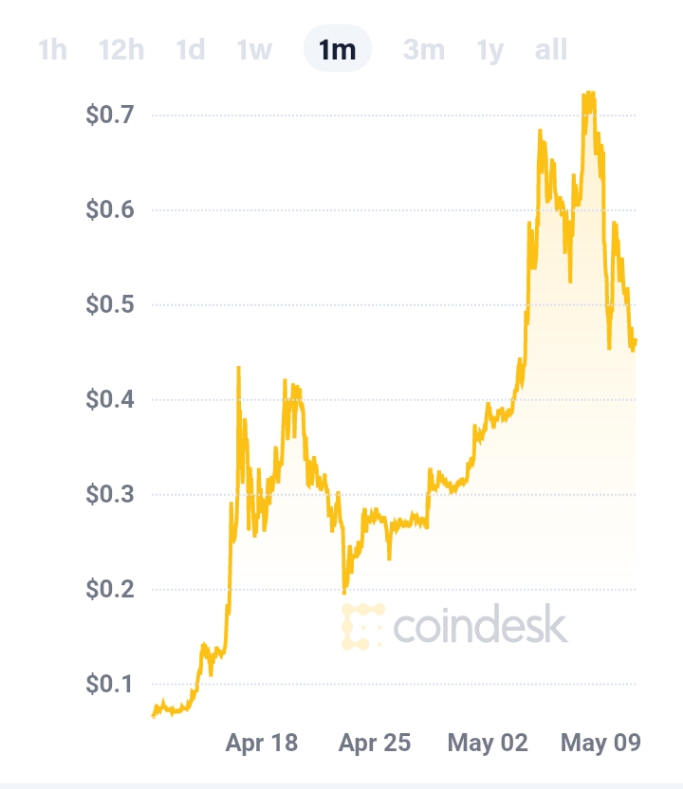

Over the past week, Doge has had what can only be described as a meteoric rise. The digital coin, which was created as a meme coin, a joke, has shocked the world by skyrocketing past expectations. In the past month, Doge went up from trading at $0.06, to a recent $0.7, a rapid gain of about 1000 percent. In the past year, the meme coin has grown by over 13,000%.

Most of its growth was fueled by interest from celebrities, one of which is Tesla and Space X CEO Elon Musk, who also happens to be the third richest man on the planet at $166 billion. However, in the past week, Doge has done a bit of crashing down, also owing to the controversial CEO Elon, who appeared on the iconic show, Saturday Night Live, with a viewership of over 12.6 million people all over the country. When asked to explain Dogecoin to the audience, he called it a "hustle", which sent the coin spiraling down even before the show was over, from $0.69 to as low as $0.43. It is currently trading at $0.469.

While Meek might not be sure how Doge works and why it seems to be moving every second, as the rapper put out a tweet asking for explanations on the coin's activity, there's no doubt, he stands to make earnings from Doge, as analysts are positive the coin will rebound soon enough.

Meek Mill's $50,000 investment could earn him millions in return in a short space of time, as crypto has so far proven to be a worthy investment.

More and more black people can be seen to be taking investment seriously and creating more wealth for themselves. In a study by Ariel Investments black millennials are investing more in the stock market now than they have in over a decade, with 67% of black millennials owning investments now compared to 57% in 1998, and 60% in 2010. Compared to the wide gap of 32% between old black people and white people who are investing (56% and 88% respectively), black millennials are investing at nearly the same rate as white millennials now, 67% to 73% - a difference of 6%.

“I’m encouraged that younger African-Americans are investing more,” said John W. Rogers, Jr., Chairman, and CEO of Ariel Investments. “Black Millennials are investing at nearly the same rate as their white counterparts.

According to President of Ariel Investments, Mellody Hobson, “If anyone were ever poised to invest with confidence, it’s the black community.”

Another study by the company reveals that more black Americans became first-time investors last year, 2020 than any other year, and they're mostly millennials.

The study reveals that 2020 saw 15% new black investors compared to only about 4% of white investors.

Although the racial wealth inequality gap is keeping more black people from investing, with the average black family earning about $45,438 real median household income, those who can afford to, are paying more attention to investments than ever before, and this will, in turn, help the racial wealth gap, which is expected take about 228 years to fix, much longer than the life-span of slavery, unless something is done.

On the other hand, black families are seeing their income grow faster than other ethnic groups, (although that growth has been severely affected by the coronavirus pandemic.)

A huge part of this is in respect to the influence of technology, which makes stock market ownership easier than ever, as millennials can invest from their phones using financial apps. This also takes away the need of investing in-person, which black people in a study have been shown to dislike, citing disrespect and condescension from financial advisors as a reason why they hardly visit investment companies.

Another factor is social media, and how it is bringing conversations about money and wealth to younger black people. More and more black people are getting influenced by their peers to create more wealth for themselves.

Beyond black millennials in the United States, black millennials in other places are also taking investments seriously, especially in Nigeria. A report by Quartz released last year showed that about $400 million was invested in crypto by Nigerian millennials alone on major local crypto exchanges, making the country only second to the U.S. in terms of volume of bitcoin traded in the last five years. Millennials favor investments in crypto as opposed to the local stock market and bonds as it retains the value in cases of international transactions,(a dollar is equivalent to 380.5 naira) and provides insulation against currency devaluation.

Be the first to comment!

You must login to comment