Micheal Burry speaks again about GameStop stock

- Posted on January 29, 2021

- Stock Market

- By admin

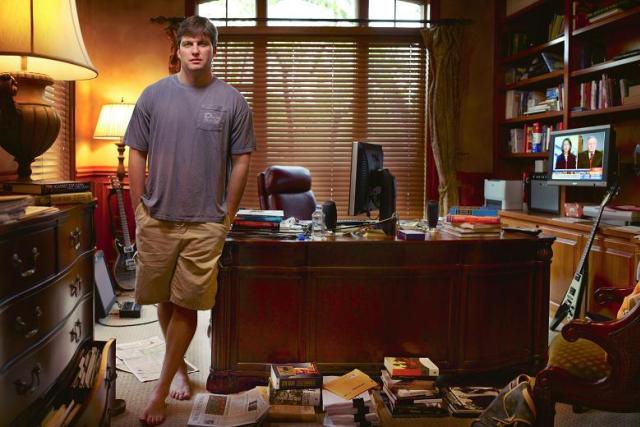

Micheal Burry is a well-known investor, he became famous during the subprime mortgage market. He accurately predicted the real estate bubble of the market during the subprime mortgage market era, he predicted and profited from shorting the subprime mortgage bonds. He made a lot of money from that trade and he is also good at picking winning stocks.

Michael Burry was the person that put GameStop on the radar of investors after his firm disclosed the list of stocks that they bought when Scion Capital’s 13F filing was released. When investors found out that Michael Burry bought GameStop, many people start buying it and the words start to spread around.

Investing groups and chats online asked their members to buy it and GameStop stock surged from $7 per share to over $330 per share. In the wake of this unprecedented stock move, Michael Burry felt like he should say something about the GameStop pumping and dumping allegations.

This is what he said, "

"No one mentioning that free trades and shares at #RobinHood were made possible by sales of the trade flow to Citadel and its ilk. Robinhood's customer is and has been CItadel, not its retail traders. Which makes what is happening this week all the more..." He added.

There really can't be another GME. Nothing else is/was even close to as shorted (100+% of float), so small (microcap) and so hated/ignored/dismissed prior to the #thebigshortsqueeze. It was a uniquely perfect set up. There won't be another like it. Much like #thebigshort.

Be the first to comment!

You must login to comment