What is the Fear and Greed index?

The fear and greed index was created to track two of the most important emotions that impact how much stock investors are ready to pay.

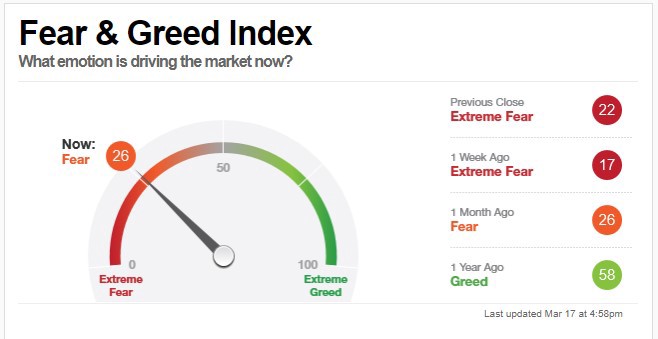

On a daily, weekly, monthly, and yearly basis, the fear and greed index is calculated. The index can theoretically be used to determine if the stock market is fairly priced.

Whenever the market turns bearish, fear pushes investors to run in despair, while greed is mostly at the foundation of irrational exuberance that can lead to share price busts.

When those feelings shift from fear to greed or vice versa, it can signal a shift in the price movement.

The Fear and Greed Index is based on the idea that extreme fear might cause stocks to become oversold or cheap, which is a buy signal.

Unbridled greed, on the other hand, can cause equities to become overbought or overpriced, resulting in mass selling.

The Fear and Greed Index is a tool that measures market levels of fear and greed, allowing investors to purchase when others are scared and sell when everyone is greedy.

Investors can control their risk and make profitable allocation decisions by understanding current stock market sentiment, such as which emotion may be influencing the market at any particular time.

For instance, if investor sentiment goes negative, sending equities down, investors may raise their cash commitment to reduce risk. On the other hand, investors will continue to increase their allocation to equities as sentiment turns favorable and stocks begin to rebound.

How the Fear and Greed index works

The Fear and Greed Index is made up of seven indicators that each reflect a distinct facet of stock market activity.

Stock price momentum, stock price strength, stock price breadth, put and call options, junk bond demand, market volatility, and safe-haven demand are the terms used to describe them.

The index measures how far individual indicators depart from their averages against how far they regularly deviate.

The index assigns an equal weighting to each indicator when computing a score from 0 to 100, with 100 denoting highest greed and 0 denoting maximum fear.

The Fear & Greed Index includes the following components:

1. Stock Price Breadth. The volume of stock shares moving up against down, which might reflect bullish or bearish emotion, is tracked with this.

2. Stock Price Strength. It keeps track of how many stocks hit 52-week highs and lows to see if they're getting overvalued or undervalued.

3. Put and Call Options. As a bullish or bear indicator, it tracks the ratio of call option trades which is the option to buy a stock, to put option trading, the option to sell a stock.

4. Market Volatility. Tracks the Chicago Board Options Exchange (CBOE) Volatility Index (VIX) as a yardstick of investor volatility forecasts for the next 30 days. Rising fears could be a sign of rising expectations.

5. Stock Price Momentum. The S&P 500 is compared to its 125-day moving average to determine how companies are valued.

6. Safe Haven Demand. The difference between stock returns and Treasury bond returns is used to determine an investor's risk appetite.

7. Junk Bond Demand. The spread between investment-grade and high-yield bond yields is used to assess investor confidence in bonds.

The Fear and Greed Index for Crypto

Fear and greed drive crypto market volatility, just as they do in the stock market, arguably even more so because there are no underlying fundamentals to analyze the market.

The cryptocurrency market is highly emotional.

When the market is rising, people become greedy, resulting in FOMO (Fear of missing out). Also, seeing red numbers causes people to sell their currencies irrationally.

The index, which is displayed and updated every eight hours on the Alternative.me website, calculates its 0 to 100 (Extreme Fear to Extreme Greed) score using four types of data.

The data used include the following:

1. Volume. The current volume is compared to historical data to determine whether the market is currently greedy or afraid.

2. Open interest. The current volume is compared to previous data to determine the present amount of greed or fear in the market.

3. Social media sentiment. The emotion expressed by Reddit and Twitter users on social media can reflect swings in sentiment.

4. Search data. Cryptocurrency search volume and trends might potentially signal shifting sentiment.

The Crypto Fear and Greed Index is a great tool because all investors have to react to a market sentiment, which is mostly influenced by emotions.

PROs and CONs of the Fear and Greed Index

There are supporters and opponents of the Fear and Greed Index. Some members of the investment world are skeptical, claiming that it promotes market timing.

Others that follow it regard it as a useful tool for assessing market sentiment when combined with fundamentals and other analysis methods.

PROs

Other technical or fundamental analyses can be used to verify sentiment indicators like the Fear and Greed Index, and vice versa.

Being able to recognize maximum greed or fear, when combined with other types of analysis, can help investors choose the best timing to buy or exit a market or a position.

Investors can use fear and greed sentiment indicators to detect their own emotions and biases, which might influence their judgments.

CONs

Any indications of a large market downturn or impending bear market are often disclosed by economic patterns and activity rather than mood indicators.

An event, such as a pandemic or terrorist attack, or other macroeconomic events that can influence the markets, cannot be predicted by market sentiment. A properly diversified investment strategy is the sole safeguard against such market-moving occurrences.

It's never a good idea to base your decisions purely on market sentiment. The Fear and Greed Index's readings should only be viewed in the context of many other variables.

Conclusion

Fear and greed are emotional experiences that can affect the stock market's trajectory.

The Fear and Greed Index tries to leverage those emotions in order to warn investors when there is too much fear or greed influencing the market, acting as a counter signal to help them make buy and sell choices.

While the index is a useful tool for evaluating market sentiment, it should only be utilized as a part of a comprehensive analysis that includes technical and fundamental data.

Be the first to comment!

You must login to comment