Apple has become the first company in the U.S to Hit a $2 Trillion Market Capitalization.

- Posted on August 19, 2020

- Editors Pick

- By Ugochukwu

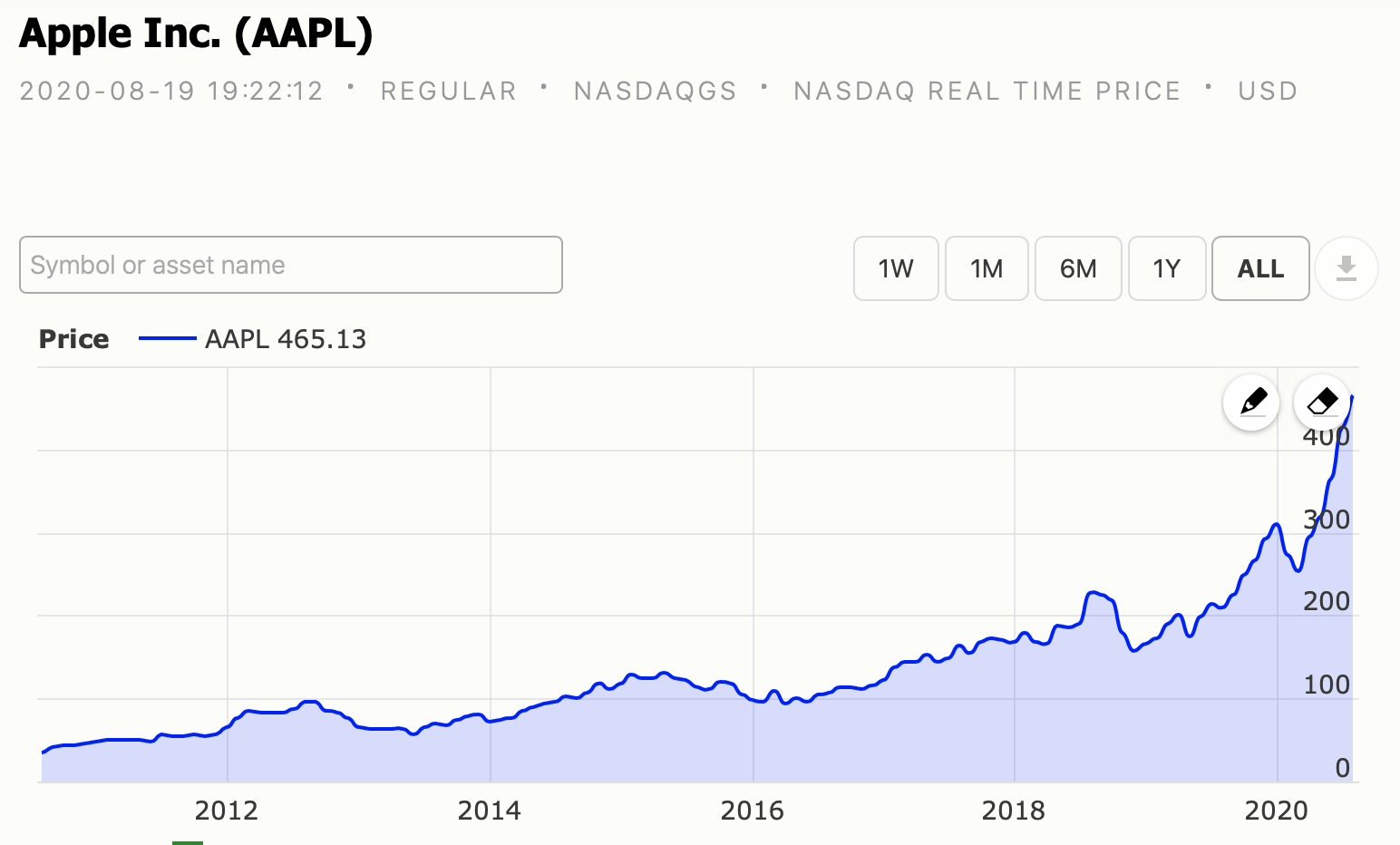

On Wednesday, Apple hit a

market cap of $2 trillion, this is double their initial valuation which was at $1

trillion in just two years after its first major hit which took over thirty

years to be achieved.

Apple has now become the

first publicly-traded company to hit a market cap of $2 trillion. It was as

well the first to reach a $1 trillion valuation on August 2, 2018, before other

tech companies like Alphabet, Amazon, and Microsoft followed suit to hit the $1

trillion market cap.

Despite the current

coronavirus pandemic which has plagued a lot of economies and businesses,

pushing some companies to file for bankruptcy, with Apple initially falling below

the mark on March 23, with coronavirus concerns. In less than five months,

Apple has doubled its market capitalization.

Apple shares are over 60%

to date, pushing relentlessly even with the pandemic. As its shares have also

risen more than 120%.

As stores were shut down

and business activities which required physical sales, there were fears, as to

what that would cost the sale of the company’s hardware, but it seems like the

pandemic has been favorable for big tech companies.

The company hit a $2

trillion milestone when its shares moved up 1.2% to $467.78 in trading on

Wednesday morning. Apple, the makers of iPhones, Mac Computers, and Apple watches

on July 31, topped Saudi Aramco to become the world’s most valuable publicly-traded

company.

Hitting a $2 trillion milestone

will further strengthen its stay at the top, while other companies work to hit

this milestone like Apple.

Apple recorded a strong third

quarter in July with revenue at $59.7 billion and also a double-digit growth in

its products and services. Despite the retails store closure, Apple revealed

that the work-from-home trends and strong online sales were a boost to its

overall operations.

As the stocks of Apple are

soaring higher as well as other tech giants like Amazon, Alphabet, Microsoft,

and Facebook, it has pushed the S&P 500 to hit a record high on Tuesday.

The five companies have

grown by almost $3 trillion since March 23, which is similar to the same growth

as the S&P 500’s next 50 most valuable companies combined which includes,

Disney, Walmart, and Berkshire Hathaway, according to S&P Global which is a

market analysis firm.

As investors are now

running to invest in big tech companies, Aswath Damodaran who is a New York University

finance professor said “It’s become the new flight to safety… Companies that

are rich, flexible, and digital are benefiting in the pandemic, and that

describes the tech Goliaths,” stating also that “This crisis has strengthened

what was already a strong hand.”

Even with the current

examination of its App store practices, the shares of Apple have continued to

soar higher.

This most recent height

by Apple has shown that the CEO, Tim Cook has done so much to bring a lot of

positive changes to the company in the last few years.

Be the first to comment!

You must login to comment