Carl Icahn dumped Hertz shares after losing $2 billion

- Posted on May 28, 2020

- Editors Pick

- By admin

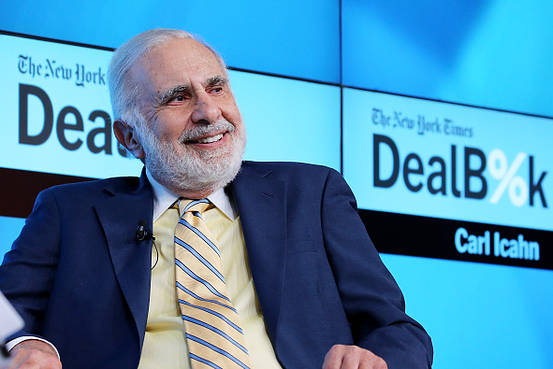

Billionaire investor Carl Icahn took a huge loss in Hertz car rental company after the company filed for bankruptcy last week. Icahn began investing in Hertz in 2014, he bought 11.4 million shares in Hertz global holdings, then he increased his investments to 26 percent ownership of the company shortly after. That brought his total investment to $2.3 billion ( 39 percent of Hertz's shares).

His investment was a smart decision until the company faced major issues due to COVID-19 and they filed for bankruptcy last week. As a result, Carl Icahn suffered a $2 billion loss and sold his investments at $0.72 per share for Hertz's stock price. He made $39.8 million from the sale.

Hertz Global Holding Inc Rental Car Company Filed For Bankruptcy Protection

"I have been an investor and supporter of Hertz (HTZ) since 2014. Unfortunately because of Covid-19 which has caused an extremely rapid and substantial decrease in travel, Hertz has encountered major financial difficulties," Icahn said in a statement filed with the Securities and Exchange Commission announcing the sale. He added that he supported Hertz's decision to file for bankruptcy.

"Yesterday I sold my equity position at a significant loss, but this does not mean that I don't continue to have faith in the future of Hertz," he said. "I believe that based on a plan of reorganization that includes new capital, Hertz will again become a great company. I intend to closely follow the company's reorganization and I look forward to assessing different opportunities to support Hertz in the future." - Icahn said about his decision to sell his Hertz shares.

NewUser says: