Berkshire Hathaway Inc - What do they do?

- Posted on August 24, 2020

- Featured Education

- By Ugochukwu

What is Berkshire Hathaway?

Berkshire Hathaway is an

American multinational conglomerate, the company owns Acme Bricks, Businesswire, Duracell, GEICO, Dairy Queen, and many others. They own some businesses outright and some in parts. Berkshire partners started operation as a small investment partnership in 1984. Now, the company has grown into one of the largest investment firms in the world and it owns about 63 companies that are generating billions in revenue annually.

It is led and controlled

by Warren Buffett, who is the chairman and CEO of the company, the company’s

vice-chairman being Charlie Munger. Berkshire Hathaway is located in Omaha,

Nebraska, United States.

Berkshire Hathaway's History - How it all started

When Berkshire was first

acquired by Warren Buffett, they were majorly focused on textiles, but with time,

it started making investments in some other companies and expanding its business

activities after the textile business didn't work out. Warren purchased Berkshire Textile mills through his partnership for $ 14 million. Sadly, the business was shut down in 1985, but Warren kept the name of the company.

Currently, Berkshire Hathaway has diversified and is involved in a diverse range of businesses which

include, retail, real estate, railroads, home furnishings, jewelry sales, gas utilities,

vacuum cleaners as well as manufacture, insurance, and distribution of uniforms.

This move made by Buffett to divert its cash flow into other businesses have proven to be very rewarding over the years, as Berkshire Hathaway has grown to become one of the largest publicly-traded companies in the world, having a market capitalization of over $507 billion as reported in August 2020.

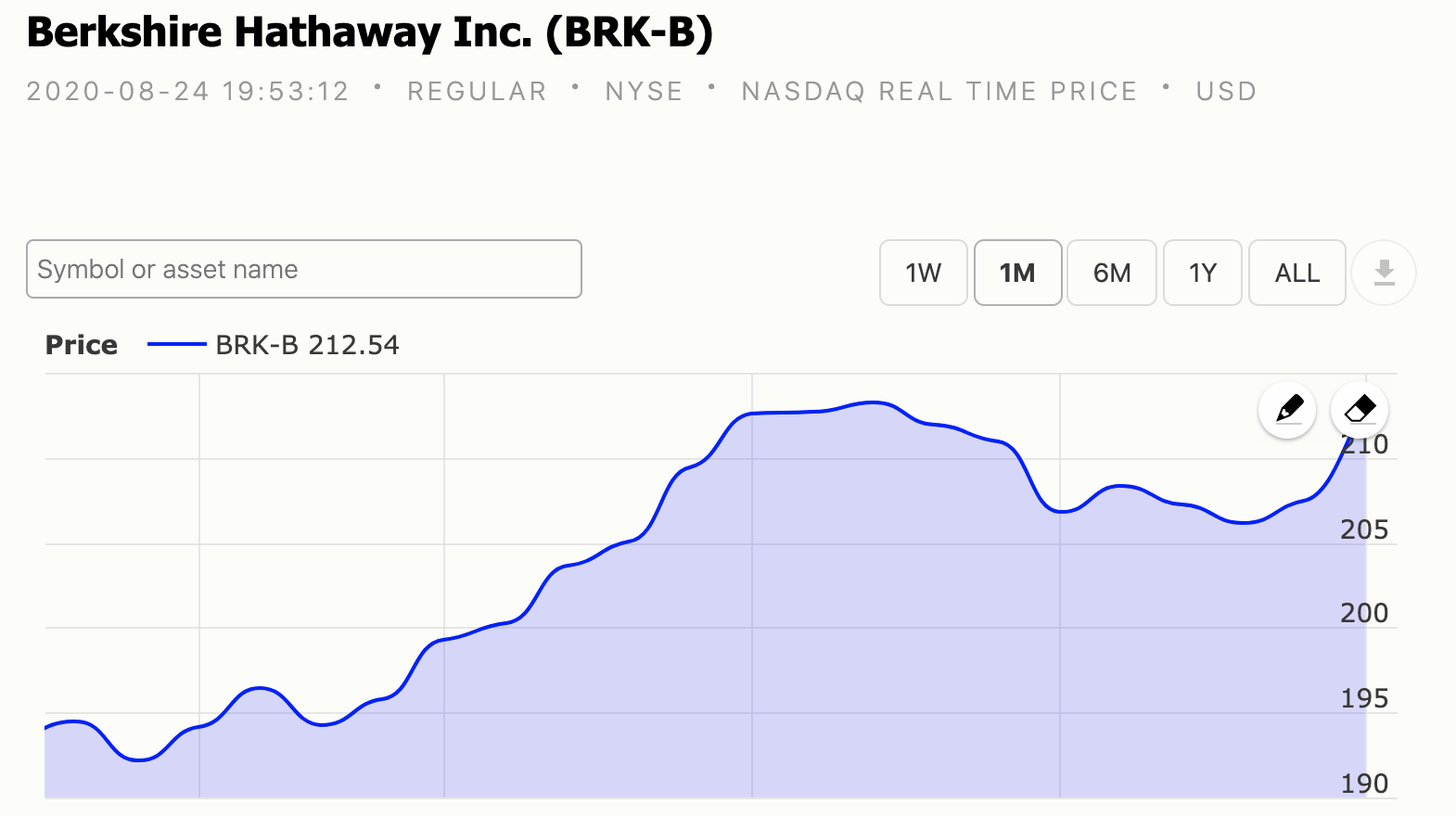

Berkshire has two classes of stocks

- BRK.A - trading at over $300k per share

- BRK.B. which is the class B stock of Berkshire Hathaway trading at over $200 per share

Berkshires's business deals

For Berkshire Hathaway, its

insurance subsidiaries happen to be a large part of its various business which

it is involved in. Some other companies which Berkshire is involved in are;

Pampered Chef, Fruit of the Loom, NetJets, Burlington Northern Santa Fe, with a

lot more that are not listed here.

It also has a minority holding

in some public companies like American Express, Bank of America, Apple, Kraft Heinz

Company, Wells Fargo, and more. Berkshire has a public market equity portfolio which

has a value of $242 billion.

When Buffett started initially,

his idea was to use the float from the insurance subsidiaries to make investments

somewhere else, with stocks that would be held for a long period.

Buffett has deliberately

avoided having a diversified stock portfolio and focused more on some trusted investments

which would be over-weighted so the anticipated return can be taken advantage

of. The investing capabilities of Buffet have become very notable and this has

made the annual shareholder’s meeting of Berkshire Hathaway to be a gathering

of value investing advocates.

From the period between

1965 to 2018, the performance of Berkshire Hathaway’s stock was twice above

that of the S&P 500 index. The stock at Berkshire was able to produce an

annualized 20.3% over that period, with the S&P 500’s annualized gain being

10%.

Considering that Buffett

is currently 88 years, there have been questions concerning the replacement of Buffet,

if his replacement would be able to continue to keep at maintain the market-out

performance of Berkshire.

Though Buffet announced

in 2010, that those who will take over from him at Berkshire would be a team that

includes a CEO and two to four investment managers. In 2011, Hedge fund

managers, Todd Combs and Ted Weschler were announced to be part of the managers.

The person who would take over and lead as the CEO is yet to be announced, but Buffett is still building the company regardless, to ensure that upon his

departure, it is still able to stand.

In 2018, Ajit Jain was put

in charge of all the insurance operations while Greg Abel was made the manager

of all other operations.

Be the first to comment!

You must login to comment