What you need to know about Saudi Aramco's Investment Shares Listing, IPO date and Valuation

- Posted on November 27, 2019

- IPO

- By admin admin

News from several sources have

revealed that Saudi Aramco's executives have met with officials of the Abu

Dhabi investment authority (ADIA) to discuss a potential investment with the

sale of Saudi Aramco shares which could raise as much as $25.6 billion.

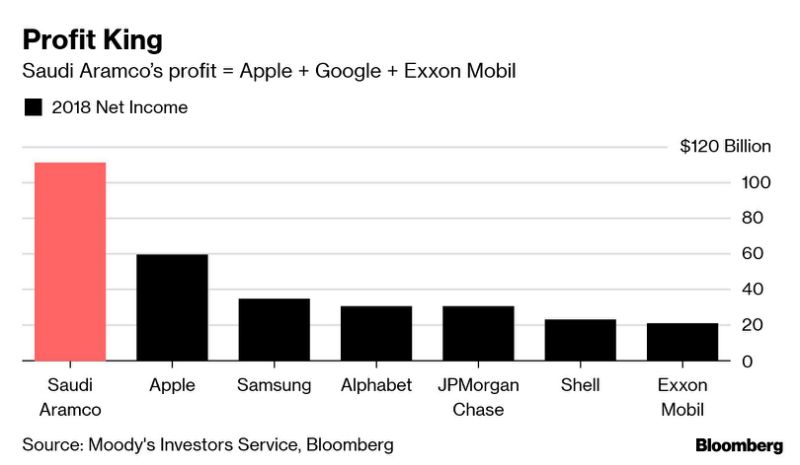

Saudi Aramco, officially the Saudi

Arabian oil company is a Saudi Arabian National petroleum and Natural Gas Company

based in Dhahran, Saudi Arabia.

By revenue, it is classified as one of

the largest company in the world. It has been reported that Saudi Aramco has

both the world's largest proven crude oil reserve (270 million barrels) and the

second-largest daily oil production.

The meeting between the world's

largest sovereign wealth funds, ADIA and Aramco, was separate to an investor

road-show in Abu Dhabi, the second phase of a Gulf marketing effort by Aramco

and its advisers.

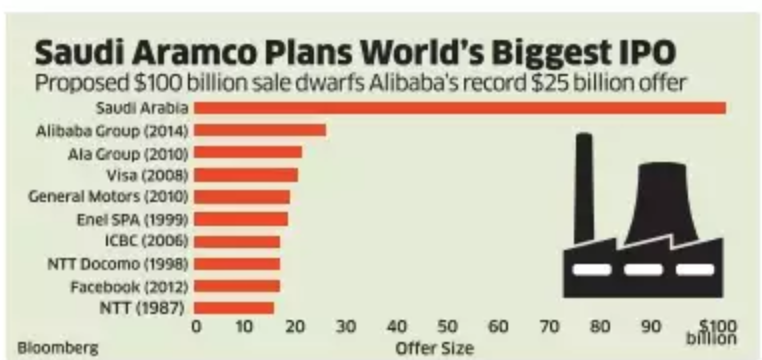

Saudi Aramco has reportedly struggled

to attract major investors for its IPO. This IPO could potentially be the

biggest in the world. It's believed Aramco have met with Kuwait Investment Authority

(KIA) and Singapore's GIC.

Some investors who attended the Aramco

road-show in Abu Dhabi on Monday expressed mixed reaction about investing in

the deal; and according to a fund manager, Aramco's future weight in bench-mark

indices was a compelling reason for fund managers in the Middle East and North

African (MEAN) region to invest in its shares.

London-based Capital Economics, in a statement issued on Monday, said, "Aramco have stepped up gear this month

but the signs are that it is unlikely to be the blockbuster sale that the

kingdom once hoped for."

Bankers have told the Saudi government

that investors will likely value the company at around $1.5 trillion, below the

$2 trillion valuation touted by Crown Prince Mohammed bin Salman when he first

floated the idea of an IPO nearly four years ago. Aramco is looking to sell

1.5% of the company in the deal, valuing the company to be between $1.6

trillion to $1.7 trillion. It has set a base dividend of $75 billion over five

years. Aramco also did not mention what measures it has taken to beef up

security following unprecedented attacks on its oil plants in September. The

Aramco deal is the center piece of Crown Prince, Mohammed bin Salman's plans to

diversify the Saudi economy away from its reliance on oil.

According to an invitation sited

by Reuters, the Aramco roadshow which

was held in Abu Dhabi was led by Yassir Mufti, Vice President of Strategy and

Market analysis, and attended by members of the oil firm's IPO team.

If the Saudi Aramco IPO goest trough, it will become the largest IPO in history. Aramco will eventually become a valuable investment for investors, however, it may take a while. The stock price may open high, then goes low before it starts growing at a steady rate.

When is Saudi Aramco IPO Date: The oil company's shares are expected to become available for purchase on the Riyadh Stock market on December 11, 2019.

How can I invest in Saudi Aramco IPO from the USA?

Individual investors living outside Saudi Arabia are not allowed to directly invest in Saudi Aramco shares because of the law that states that only institutional investors can invest in the company; say the people familiar with the subject. Also, qualified institutions must have at least $500 million in assets under management and be subjected to a jurisdiction that applies to similar standards to Saudi Arabia. Furthermore, the institutional investors must apply for a licence from the Saudi financial markets regulators to become a Qualified Foreign Investor ( QFI).

Be the first to comment!

You must login to comment