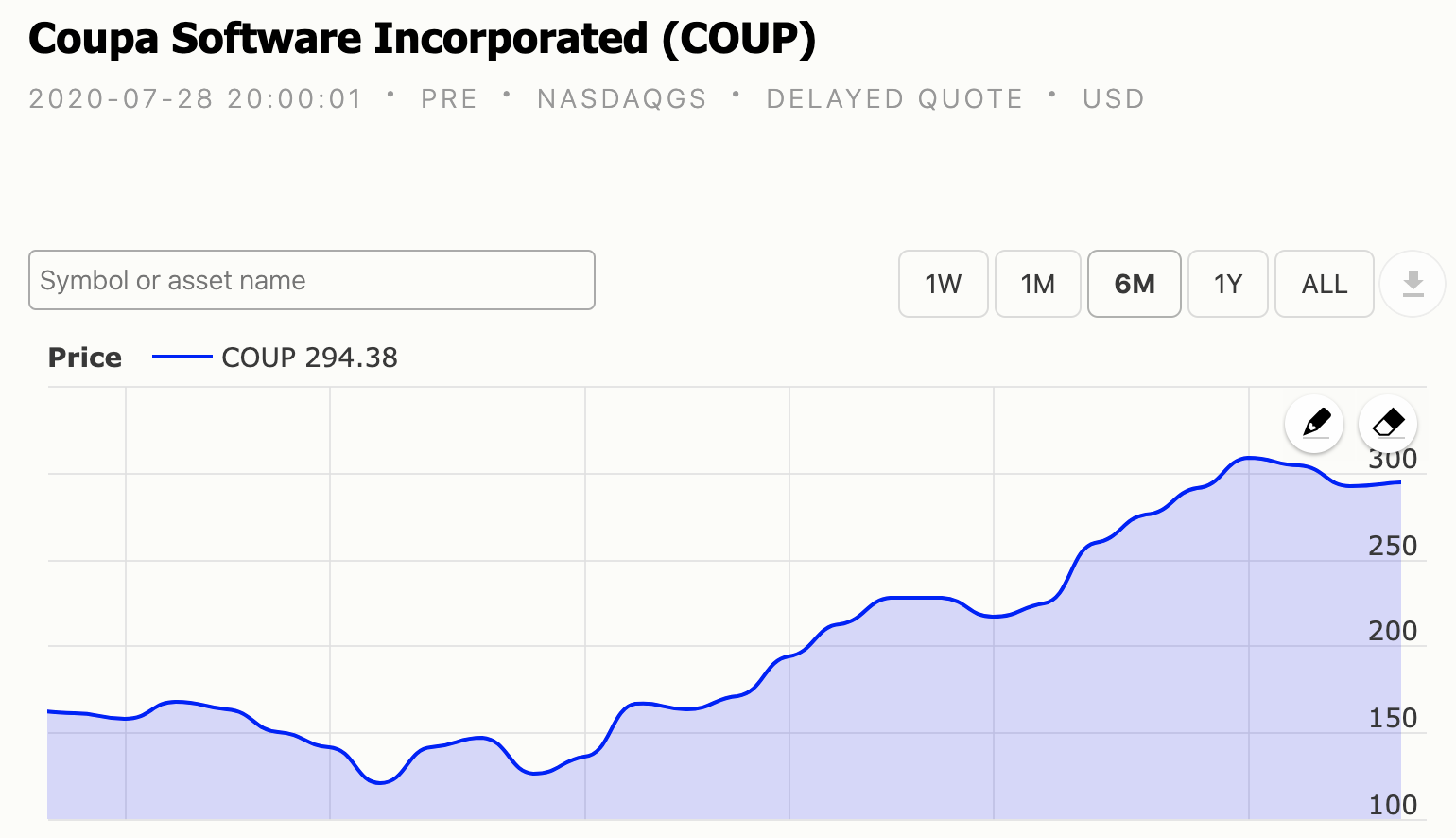

Coupa Software Stock Soars 200% between Mid March and July

The expense software provider, Coupa (COUP) software company's stock rose to beat analysts' prediction after its severe fall in March. The software company stock is said to have risen with about 172% from $110 as of March to $298. Coupa stock is believed to have risen from off its recent bottom and even more than S&P 500 stock which moved 43%.

After the outbreak of the coronavirus pandemic in March, Coupa stock fell from $173 to $110, a rate which is around 37% and more than the S&P 500 which fell around 34%. However, with the current surge in the stock value, it is said to have risen by up to 374% when compared to its rate in 2019.

Coupa stock has recovered from its pre-crisis level in February when it fell by 37%. The current increase seems to make the company stock fully valued because the impact of the pandemic would most likely reduce demand and supply this year than it was last year.

Over the years, Coupa stock price experienced an increase of about 109% in revenue. This in turn led to a 77% rise in the revenue per share despite the 18% rise in the outstanding share price. However, earlier this year, the company experienced a decrease in its profitability as the earning per share dropped from -$0.83 in 2018 to -$1.45 in 2020. This was revealed in the company's fiscal year report which ended in January. This increase was triggered by the surge in interest rate. Notwithstanding, Coupa operating margin increased from -24% in 2018 to -19% in 2020.

Although the company recorded a 109% rise in its revenue over the years, the company's Price-to-Sales multiple (P/S) rose from 17.8x in 2017 to 32.4x in 2019. This year, the Price-to-Sales multiple (P/S) has risen to 47.7x. Here are some of the factors that triggered the increase.

Factors that triggered the increase in the value of Coupa software.

The factors that triggered the rise in the stock value of Coupa software can be broadly divided into three:

Coupa Software Demand

The outbreak of the coronavirus pandemic in the United States in March led to the enforcement of social distancing and lockdown as some of the measures to contain the virus. This subsequently made some businesses and companies to start adopting the online method of transaction as a way to keep themselves in service. The rise in the number of businesses going online triggered the rise in the demand for Coupa software. Hence, the company started experiencing some turnarounds which include:

Benefiting from work from home.

One of the factors that triggered the rise in Coupa software stock is the work from home put in place by companies and businesses after the enforcement of the lockdown measure. The global outbreak of the coronavirus and the resulting lockdown inadvertently made businesses and companies start cutting down costs. Coupa benefited from this because one of the goals of the software is to analyze corporate expense data so as to reduce all unnecessary spendings. This increases the demand for software services and triggered the rise in the company's stock.

Coupa also benefited from the

Cloud-based spend management app

Companies moving supply chain management online

Analyst confirmation that coupa software is powerful and user friendly

Aside from this, the company benefited from its stock's Bull and Bear Stock Market. Here is how Coupa benefited from this.

Coupa Bull Market

A lot of investors are bullish about Coupa Software due to the many services and products that the company offers. Since the Pandemic, Coupa has been able to

- Retain more customer via subscriptions

- Experience a greater need for cloud-based supply chain management due to COVID-19.

Also, the lockdown and social distancing measures triggered about $56 billion market opportunity for supply chain software. This implies that supply chain software benefited immensely from the outbreak as it increases the demand in their services. With Coupa as one of the best software companies that deliver excellent results, this assured investors that their investment would make a good return. It also triggered more investment in the company's stock.

Coupa Bear Market

Although the outbreak of the coronavirus pandemic did not affect software companies as much as other businesses, it generally affects the nation's economy. To avoid investors losing hope in the company's stock and to keep the business afloat, Coupa software put in place some measures. These include:

Reduction of spending

Reduction in Workforce

Increase use of AI

Be the first to comment!

You must login to comment