Flutterwave, Eversend and other African fintech startups discontinue virtual card services

Many African fintech firms that provide virtual

dollar card services informed their customers through email on Friday that

their services would be discontinued effective on Saturday, July 16,

2022.

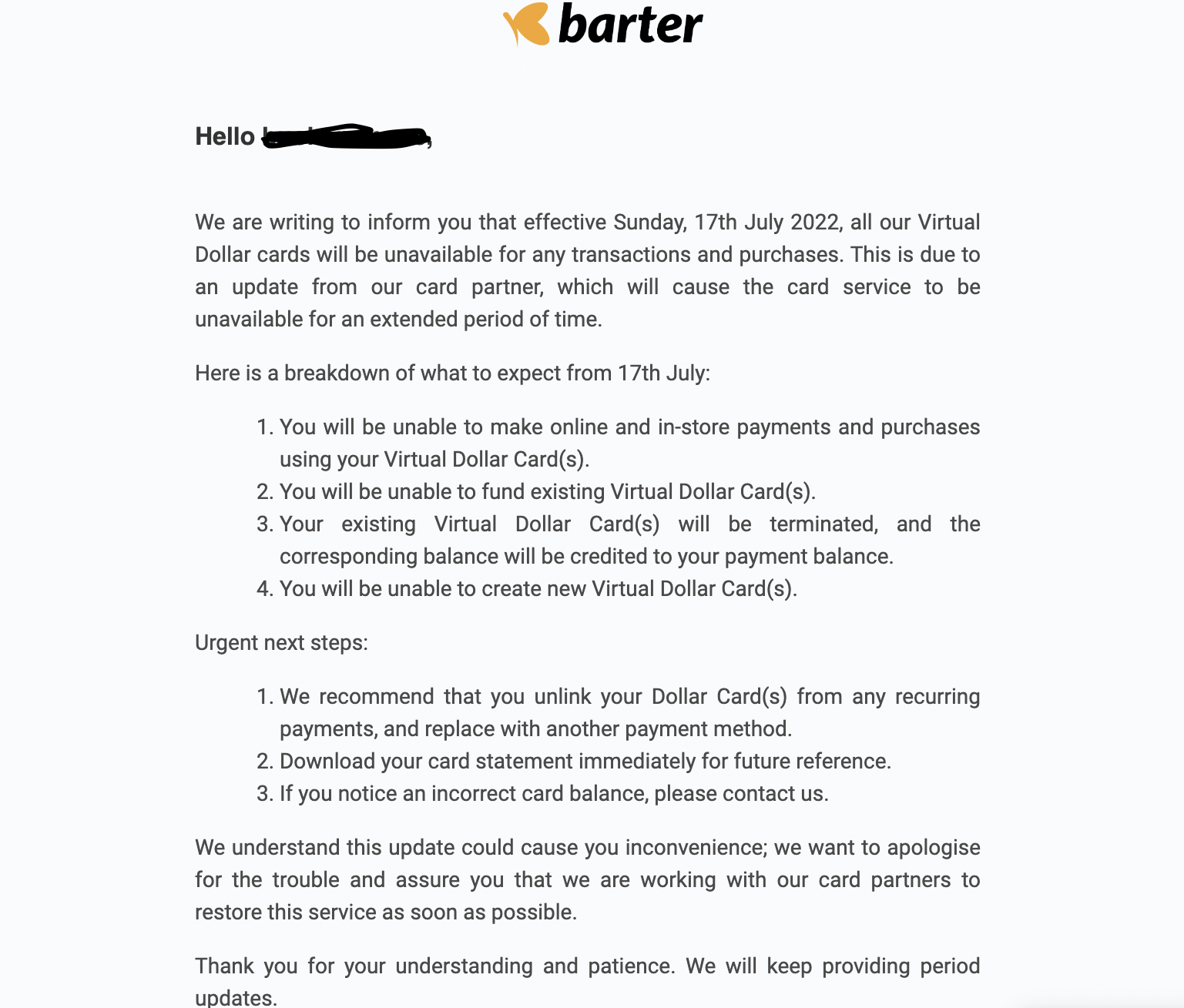

Flutterwave, a Nigerian-based unicorn, informed

Barter users in an email that all its Virtual Dollar cards would be

unusable for any payments and purchases as of Sunday, July 17, 2022. It cited

"an update from the company's card partner" as the cause of this

cancellation.

This means that Nigerians who use such

services won't be able to make online transactions or purchases using

the Barter virtual currency card. Furthermore, they won't be able to fund

virtual cards that are already in use because the balance on those cards would

be credited to consumers' payment accounts when they are cancelled.

In November 2018, Flutterwave created Barter as

a payment solution to enable customers to move money to and from Africa

for nothing. Additionally, the program made it easy and hassle-free to pay

bills, receive money from abroad, and generate virtual cards for online

shopping.

Many other startups that use Flutterwave to

offer virtual cards to their consumers are likely to be impacted by this

announcement.

Similar alerts were also published by other

financial businesses, such as the Ugandan Eversend, the crypto exchange Busha,

and Payday with its headquarters in Rwanda.

The "card partner" that these fintech

companies are referring to is unclear, but they have all issued virtual

cards that are supported by MasterCard and Visa—two of the biggest worldwide

card issuers.

The closure of 56 bank accounts owned by seven

different companies was mandated by a Kenyan court after the Asset

Recovery Agency notified the court that the suspicious accounts

were used as channels for financial fraud while pretending to

be merchant accounts. The news of the virtual card suspension comes

in the wake of the Kenyan court's order.

Flutterwave has denied the allegations and asserted

that it has supporting evidence for its claims.

Investigations into the bank account activities,

however, turned up questionable activity, including the possibility that money

was being received from specific foreign corporations, the ARA claims. The

money was subsequently transferred to related accounts rather than being paid

out to merchants.

Flutterwave responded by stating that it had a duty

to safeguard the environment's integrity and that it was committed to working

with all stakeholders to do so. It declared that it was working to make the

data transparent and ascertain the cause of the false claims.

‘What customers are saying’

Individuals and businesses impacted by the

unexpected decision took to social media to express their displeasure at

the broad cancellation of virtual card services on the continent.

“It affects us in a big way because all our Facebook

ads are connected to our Barter virtual card,” Douglas Kenydson CEO Selar said.

“Our Amazon web services (AWS) plan is also connected, and you can’t even

afford to miss one payment, or else they’ll take you off.”

Kendyson expressed doubt on the banks in Nigeria's

switch to the current virtual cards. He complained about having to

exchange money and possibly dealing with declined credit card payments. The best

course of action for him is to use the virtual card services of Mercury, a

digital bank for startups based in San Francisco that in March blocked the

accounts of dozens of African startups.

Be the first to comment!

You must login to comment