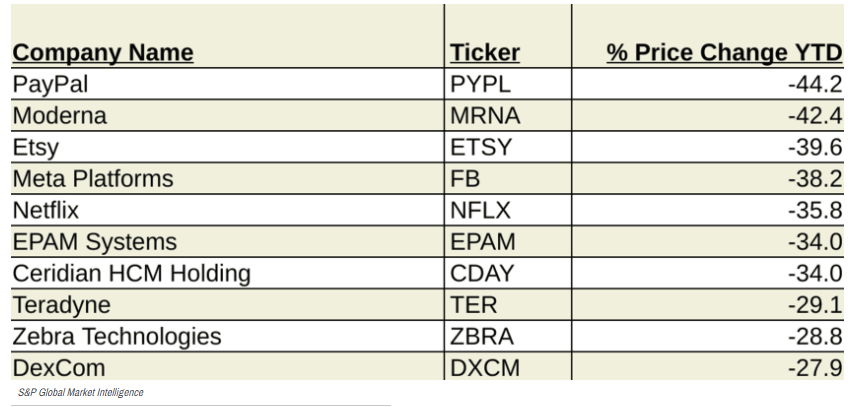

The worst performing stocks so far this year

- Posted on March 04, 2022

- Stock Market

- By Glory

Despite the instability

in the stock market at the start of 2022, the Dow Jones Industrial Average has

shown its resilience, dropping only about 2% for the year.

In comparison to the

Nasdaq Composite and the S&P 500, which have both dropped by 8% and 4% to

begin the year, the Dow appears to be as steady as ever. Despite outperforming

its rivals thus far this year, three of the Dow's components have dropped more

than 10% in January 2022.

Even for mega-cap

companies, the stock market may be brutal. However, if an investor's risk

appetite permits, such stocks can provide long-term stability to their

portfolios. As a result, it's critical to keep a watch on such stocks,

especially while they're falling.

The S&P 500 is down

about 9% year to date, but the worst performers in the major benchmark of US

equities performance are falling far worse. The S&P 500's most battered

names share a few characteristics, ranging from small, obscure index members to

the world's best-known and largest stocks.

For starters, they're all in bear market territory, with prices down at least 27% year to date. Some of these equities are experiencing the ramifications of being among the year's biggest winners. Many stocks that soared in 2021 as pandemic or COVID-19 recovery trades have lost a lot of their value this year.

Worst performers in

January 2022

PayPal: (PYPL, $105.20)

was the S&P 500's worst performer through February 17, losing more than

44%. Earnings that fell short of Wall Street's expectations hurt, but the

company's lack of user growth was far more harmful. Worst of all, PayPal's

sales and profit projections were lowered. When high-priced growth stocks fail

to meet previous and future expectations, they have no chance in this market.

The selling pressure was exacerbated by a succession of analyst devaluations

and price target reductions. "It will likely take several quarters of

better results to restore investor confidence," says Argus Research

analyst Stephen Biggar. He recently cut his profit forecast and price goal for

2022 but kept his Buy rating on the stock.

Meta:

Shares of Facebook parent company Meta (FB, $207.71) plunged more than 38%

year-to-date through Feb. 17 following a poor fourth-quarter report. Changes to

Apple's (AAPL) iOS privacy restrictions impacted Facebook's major advertising

business. TikTok and other rivals are luring users away from Meta. To

complicate things the company issued a bleak forecast. It's also pouring

billions of dollars into the metaverse, a project that may take years to

complete and isn't guaranteed to succeed. The market value of Facebook has

plunged by $356 billion by 2022, causing havoc on the market-cap-weighted

S&P 500.

Netflix:

(NFLX, $368.07) Netflix's Q4 earnings report acted as a catalyst for the

stock's dramatic drop in January. While the company's Q4 revenues of $7.71

billion were in line with analyst expectations, and GAAP EPS of $1.33 topped

predictions by $0.50, subscriber additions of 8.3 million in the fourth quarter

fell short of the company's guidance of 8.5 million. The most concerning

component, though, was the subscriber addition projection for Q1 2022.

Typically, Q1 is a good quarter in terms of customer additions, and investors expected

subscriber growth to revert to normal in FY2022, after a rather weak FY2021.

Moderna: (MRNA,

$146.36) was one of the best-performing companies in the S&P 500 in 2021,

rising 140%. Investors are weighing the

company's fate on the opposite side of the pandemic, with shares down more than

40% year to date. In late January, UBS Global Research initiated coverage of

MRNA at Neutral (the equivalent of Hold), highlighting the potential of the

company's medications in development.

Be the first to comment!

You must login to comment