How The W-4 Withholding (IRS Withholding) Could Affect Finances In The Coming Year

With 2020 in view, a new

set of rules and regulations have been put in place; some of which could affect

our finances in the coming by either building them up or slowing them down. We

have the adjusted IRS withholding tables that may influence take-home pay and

help taxpayers avoid costly penalties, the minimum wage increases in 25 states

and the amended overtime pay requirements.

Investing Port has

researched to see how each of these new rules could affect our finances and

would be focusing on the W-4 Withholding in this article.

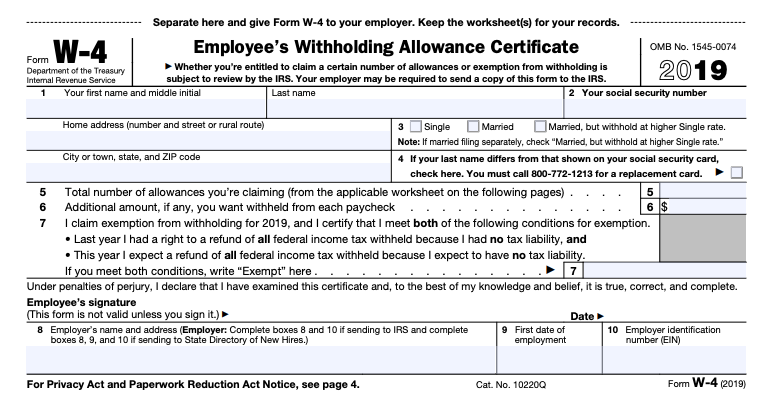

W-4 Withholding

Recently,

the federal government issued a new, more detailed, version of Form W-4, also known

as the Employee’s Withholding Allowance Certificate. The changes range from the

2017 Tax Cuts and Job Act (TCJA), which altered federal income tax rates and

brackets starting in 2018, and in turn, shifted IRS withholding tables.

Pete Isberg, vice

president of government relations for ADP, spoke to Yahoo Finance saying, “This

is essentially a delayed reaction to the TCJA that took effect in 2018. Income

tax withholding essentially has undergone a very major overhaul for 2020 that

could be a source of confusion.”

Changes made to the current W-4 Withholding form

· The most important change to the W-4 Withholding is

that the IRS has done away with the “allowances” method to estimate

withholding.

Isberg further said,

“Withholding allowances have been the basis for payroll withholding forever. So

that's going to cause a little confusion.”

· Another change is that which will impact taxpayers

with multiple jobs and married filers filing jointly.

Isberg commented saying,

“The tax tables just assume that spouses earn about the same amount, and it

divides the standard deduction and the tax brackets kind of equally between two

jobs." The new section replaces a 9-step process that was previously used

to estimate withholding for multiple income households.

· An elective section allowing taxpayers to withhold

for separate sources of income, such as interest, dividends, and retirement

income was also changed.

Taxpayers who have

previously submitted a Form W-4 and have not sent in the new version are not

required to update or replace their submission. However, penalties for

underpayments resulting from outdated form calculations will be assessed for

the first time beginning with filings for the 2019 tax year. Those who begin

new employment after 2019, or wish to adjust their withholding, must complete

the new form.

The IRS reminds taxpayers

to recheck withholding again at the start of 2020 on its website. The agency

says a reassessment is important, for

those taxpayers who reduced withholding in 2019, or did not file a new Form W-4

for 2020. The agency provided a calculator to

estimate withholding is also provided on its website.

Ultimate

Credit:

Yahoo

Finance

Be the first to comment!

You must login to comment