Millions of people are facing evictions and they are mainly black Americans

As coronavirus lockdowns are being eased, and the economy slowly reopening, threats of evictions lurk around the corner which will affect millions of people especially those in the Black communities.

Many states put a halt to evictions since mid-March when the spread of the coronavirus peaked. The conditions placed on rental payments gradually begin to reduce as the economy slowly reopens and lockdown restrictions lifted.

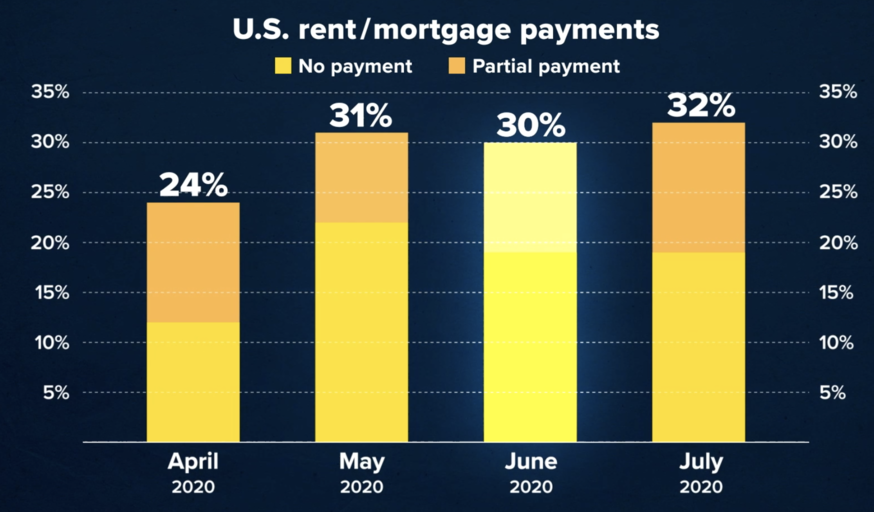

Keynote about the eviction rates and housing condition in the US

- Millions of Americans are facing eviction and the Democrats are doing something about it

- 28 million are facing eviction

- Landlords cant pay mortgage

- Tennants without jobs are having issues paying rent.

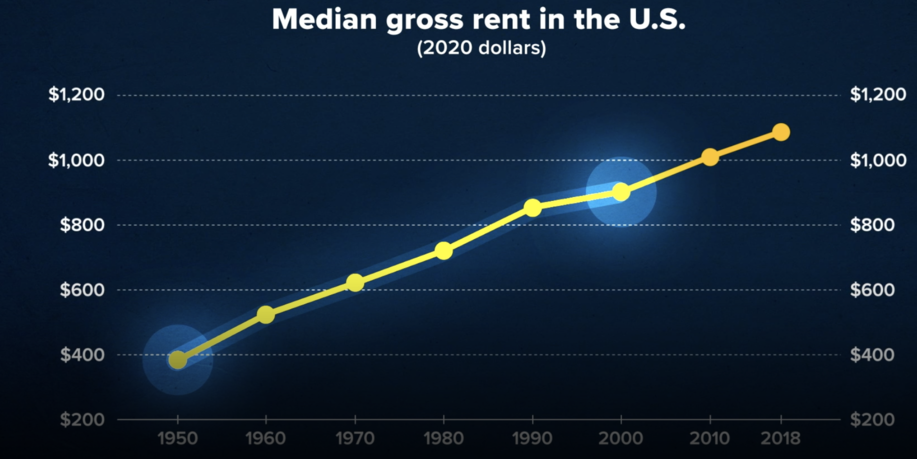

- 40.6 percent rent-burdened and spend 35% of their income on housing

- Almost 1 million evictions per year between 2000 - 2016

“There’s every reason to believe that this will result in a pretty serious rental market housing crisis,” said Peter Hepburn of Eviction Lab at Princeton University.

Concerns surrounding possible evictions of more than 28 million Americans have put lawmakers on their feet to look for possible ways to stop evictions and foreclosures during the pandemic. Landlords are also seeking new ways to ease the burden off their tenants, like lease guarantees.

According to a survey done in May by the American Apartment Owners Association, nearly 60% of landlords said their renters were unable to pay rent due to the coronavirus pandemic. While 80% said they were willing to cooperate with the tenants.

“We made it pretty clear to out landlords that people aren’t just suddenly going to be able to afford to pay back everything they owe on one day,” said the association’s director of marketing and education Alexandra Alvarado. “So it doesn’t make sense to create a plan that isn’t realistic.”

By using a lease guaranty Landlords could shield against nonpayment of rent or damages, according to Alvarado.

“We call it a security deposit alternative. It allows people to not have to pay a full security deposit. And then, you know the landlord id protected for thousands of dollars just in case something happens down the road. It is a small fee than the tenant has to pay to get it, but it is definitely less than what a security deposit will be,” she said.

Read More

REAL ESTATE INVESTMENT TRUSTS (REITS): MEANING, TYPES, ADVANTAGES, AND DISADVANTAGES

The coronavirus pandemic is one that has taken the whole economy by surprise, therefore, there has to be a level of understanding between landlords and their tenants. While payment defers is helpful to those directly affected by the impacts of the pandemic, it could also have longer-term effects for both the landlords and the tenants.

“The rent itself has ripple effects for the entire community,” said Emily Benfer a visiting professor of law at Wake Forest University. “When the rent isn’t paid, the mortgage isn’t paid, property taxes go unpaid, employees are unpaid, conditions that needed repairs are delayed. And the entire community ends up suffering—from the school system to services that the community provides to residents.”

The real estate market will never be the same again due to the coronavirus pandemic. Many people have lost their jobs and between 1 million to 2 million people are filing for unemployment per week. Also, many black Americans are most likely to be facing eviction than other races due to income disparity.

Be the first to comment!

You must login to comment