Credpal gets funding of $15 million to boost Buy Now, Pay Later Services in African Market

- Posted on March 30, 2022

- Technology

- By Osinachi Gift

Buy now pay later (BNPL)—a short-term consumer financing that allows shoppers to acquire products online and pay in instalments with miminal or no fees—is sweeping the global e-commerce sector. Afterpay, Klarna, Affirm, and Zip are some of the players overseeing this arrest while tech and payments giants Apple, Square, PayPal, and Visa have their respective BNPL initiatives as they look to get a slice of the action.

In Africa, BNPL training is starting up to take shape and one of the innovators in this territory, CredPal, on Tuesday declared that it’s put forward $15 million in a bridge round encompassing equity and debt. This will be employed to improve its customer credit offerings in its home country, Nigeria, and scale across Africa.

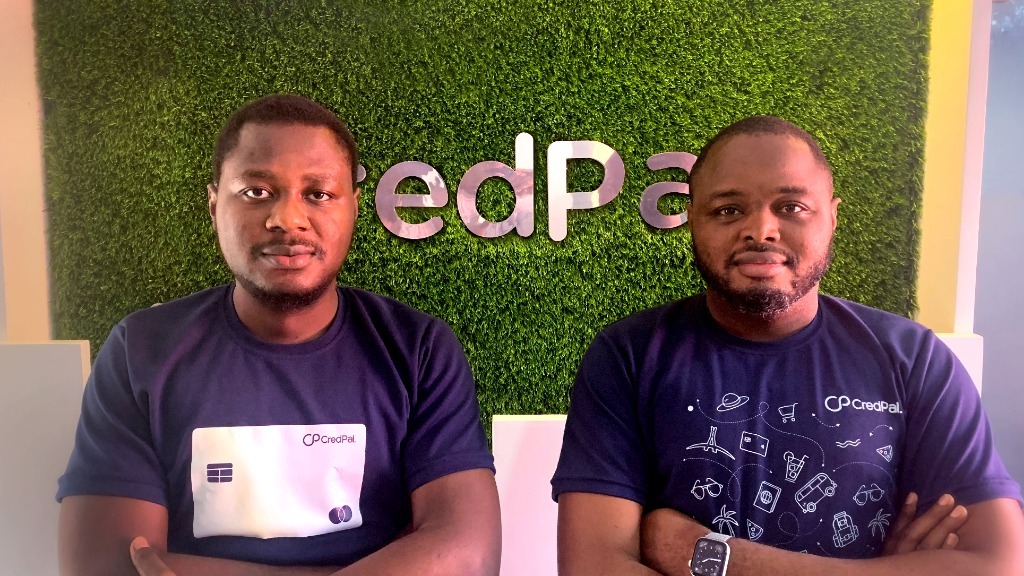

Launched in 2018 by CEO Fehintolu Olaogun and COO Olorunfemi Jegede, Y Combinator- and Google-backed CredPal enables people and companies to pay for assets in instalments across online and offline merchants, for both enormous and small-ticket items—from as low as ₦2,000 up to ₦5 million. credal claims to have over 85,000 active customers and more than 4,000 active merchants.

In addition to contributing infrastructure that enables banks and other financial organizations to distribute customer credit in real-time, CredPal offers its customers access to credit cards, which was established in November 2020.

“What we’ve done is encapsulate the lifestyle of the typical working-class Nigerian and guarantee that every individual can discover something precise for them on CredPal,” Olaogun asserted in a fresh interview. “For example, a professional who receives ₦250,000 can get a credit card with a limit that they can spend back at the verge of their billing cycle or use it to purchase now and pay later.”

With the recent funding, the startup agendas to expand cooperations with dealers through its newly deployed CredPal Pay, an omnichannel dealer suite that permits companies seamlessly receive buy now, pay later. The point-of-sale infrastructure encourages BNPL through numerous means, including a credit revenue link, checkout plugin, QR codes, and a transaction administration system.

“Our assurance to enhance credit facilities for African customers and assisting vendors cultivate their sales is receiving an enormous increase with these latest milestones,” Olaogun asserts in a statement.

The latest allotment brings the total investment conserved by CredPal to $16.7 million, per Crunchbase data, having previously raised $1.5 million in 2020, part of which was used to roll out its credit cards.

Contributing in this bridge tour are subsisting investors, including Greenhouse Capital (which is also an investor in Kenya’s BNPL startup Lipa Later), as well as new backers entailing Uncovered Fund, LongCommerce, First Circle Capital, and Adii Pienaar, co-founder and former CEO of WooCommerce. Meanwhile, several undisclosed financial institutions provided the debt facility.

The sponsoring statement occurs simultaneously with a fresh coalition with Airtel Nigeria to stimulate customers across Nigeria to access BNPL to acquire smartphones and broadband modems, CredPal says, without sharing specific details abotut the deal.

The fresh investment will also support the startup’s planned expansion across Africa, starting with Kenya, Egypt, Ghana, and Cameroon, the company said.

With the bulk of African consumers severely starved of efficient and sustainable credit solutions, the BNPL movement is waxing strong across the continent and so is the competition among players.

One of the early companies in the space in Kenya and there is M-Kopa—which has since expanded into phones and retail products—in Kenya, Uganda, and Nigeria. CDC, PayQart, and Carbon also play in Nigeria. And in South Africa, there are PayJustNow and Payflex. The latter was recently acquired by the Australian BNPL Zip.

While competition appears to be heating up, there is a significantly large market of consumers and merchants to be tapped. But success will largely be determined by how effectively players can drive the adoption and use of credit financing and cards by African consumers.

Be the first to comment!

You must login to comment