What to do when the stock market is crashing

- Posted on February 22, 2022

- Editors Pick

- By Glory

First things first. DO

NOT PANIC!

When stocks are falling

and the value of people's portfolios is plummeting, panic selling is a common

reaction. As a result, it's critical to understand your risk tolerance and how

price fluctuations—or volatility—may affect you ahead of time. Hedging your portfolio

through diversification—holding a variety of investments, including some that

have a low degree of connection with the stock market—is another way to reduce

market risk.

It is understandable to think

whether or not it is the best choice to pull your money out of the stock market

amid a current crash, and the value of your portfolio plummets. It may seem

like the reasonable thing to do but probably not the best option.

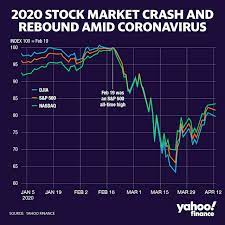

The most recent stock

market crisis occurred in early 2020, with the emergence of the COVID-19

pandemic which remains a major source of market volatility. However, the

current market crash is beyond the pandemic. Market downturns are common and

can be triggered by a variety of circumstances. In early 2022, markets were

down not only due to pandemic fears, but also due to concerns about rising

inflation and interest rates.

Based on the history of

the stock market we can tell how long crashes, corrections, and bear markets have

lasted, but there is no telling how long and severe future declines may turn

out. For example, the S&P 500 stock index fluctuates between -1%and 1%,

anything outside of these parameters may be deemed an active day on the stock

market. Trading may be paused for 15 minutes if the S&P 500 declines 7% in

a single day which has only happened a few times in the history of the market,

and it represents a bad day for Wall Street.

Long-term investors

understand that the market and economy will eventually revive, and they should

be prepared for it. The stock market fell during the 2008 financial crisis, and

many investors lost their assets. The market, on the other hand, bottomed out

in March 2009 and finally rebounded to its previous highs and beyond. Panic

sellers may have missed out on the market's surge, but long-term investors who

stayed in the market rebounded and did better over time.

So, here are 4 ways you can

survive a market crash:

1.

Know your risk tolerance: Your

risk tolerance is determined by a variety of factors, including your investment

time horizon, monetary needs, and emotional reaction to losses. It is important

to thoroughly research the stock market and have a record of the strengths,

flaws, and purpose of each investment in your portfolio. Your findings will

serve as a concrete reminder of the characteristics that make a stock

worthwhile to hold. A rapid fall in the value of an investor's portfolio is

disturbing to say the least for inexperienced investors. That is why it is

critical to determine your risk tolerance before you begin building your

portfolio, rather than when the market is in the midst of a sell-off.

2.

Diversify your portfolio: Diversification,

or spreading your money over a variety of investments, is critical for lowering

investment risk and surfing safely through a volatile market. Diversifying your

investments ensures that they aren't all invested in one place. As a result, if

one stock or industry has a bad day, your other assets may be able to

compensate for the losses. Downside risk can be mitigated to a degree by

diversifying your portfolio and employing other investments like real estate,

which have a low correlation to equities. Diversification is defined as

allocating a portion of your portfolio to stocks, bonds, cash, and alternative

assets. Every investor's situation is unique, and how you divide your portfolio

is determined by factors such as risk tolerance, time horizon, and goals. You

may avoid the risks of putting all your eggs in one basket if you use a

well-thought-out asset allocation strategy.

3.

Prepare for possible losses: You

must understand how the stock market operates in order to invest with clarity.

This helps you to study unanticipated downturns and decide if you should sell

or buy more stocks. Mostly, be prepared for the worst-case scenario and have a working

strategy in place to mitigate your losses. If the market crashes, investing in

only equities could result in a large loss of capital. Investors intentionally

make other investments to diversify their portfolio and reduce risk in order to

hedge against losses.

4.

Focus on the long-term: Despite

the fact that stock market returns can be extremely unpredictable in the short

term, they beat practically every other asset class in the long run. Even the

biggest declines appear to be minor glitches in the market's long-term upward

trend when seen over a suitably extended period of time. This is especially

important to remember amid volatile periods when the market is on the downturn.

Having a long-term perspective will help you to see a major market crash as an

opportunity to build wealth, rather than a threat to clean out your investment.

Usually, in major bear markets, investors sell stocks regardless of quality,

creating an opportunity to buy certain blue chips at reasonable prices and

valuations.

Why should I invest?

Investing helps you

protect your retirement, make the most of your money, and expand your wealth

through the power of compounding. According to a Gallup poll conducted in July

2021, 44 percent of Americans do not invest in the stock market due to a lack

of confidence in the market as a result of the 2008 financial crisis and the

recent market volatility. Also, those who don't have enough funds to get by

month to month don't have money to invest in the stock market.

According to Gallup, from

2001 to 2008, an average of 62 percent of U.S. adults indicated they owned

stock, a number that has never been surpassed since. A stock market drop,

whether caused by a recession or an exogenous event like as the COVID-19

pandemic, can put basic investing principles to the test. It's crucial to

remember that the stock market is cyclical, and that stocks will inevitably

fall in value. However, a dip is only brief. Instead of panic selling when

stock prices are at all-time lows, it's better to look long-term.

Be the first to comment!

You must login to comment